A couple of years ago, payments orchestration was a foreign term to many large companies Juan Pablo Ortega would speak to. Today, the Yuno co-founder and CEO doesn’t have to do as much explaining.

“The perception has changed dramatically,” Ortega told TechCrunch. “Many large companies are now well aware of what payment orchestration is, and actually a few of them are starting to do requests for proposals just for orchestration.”

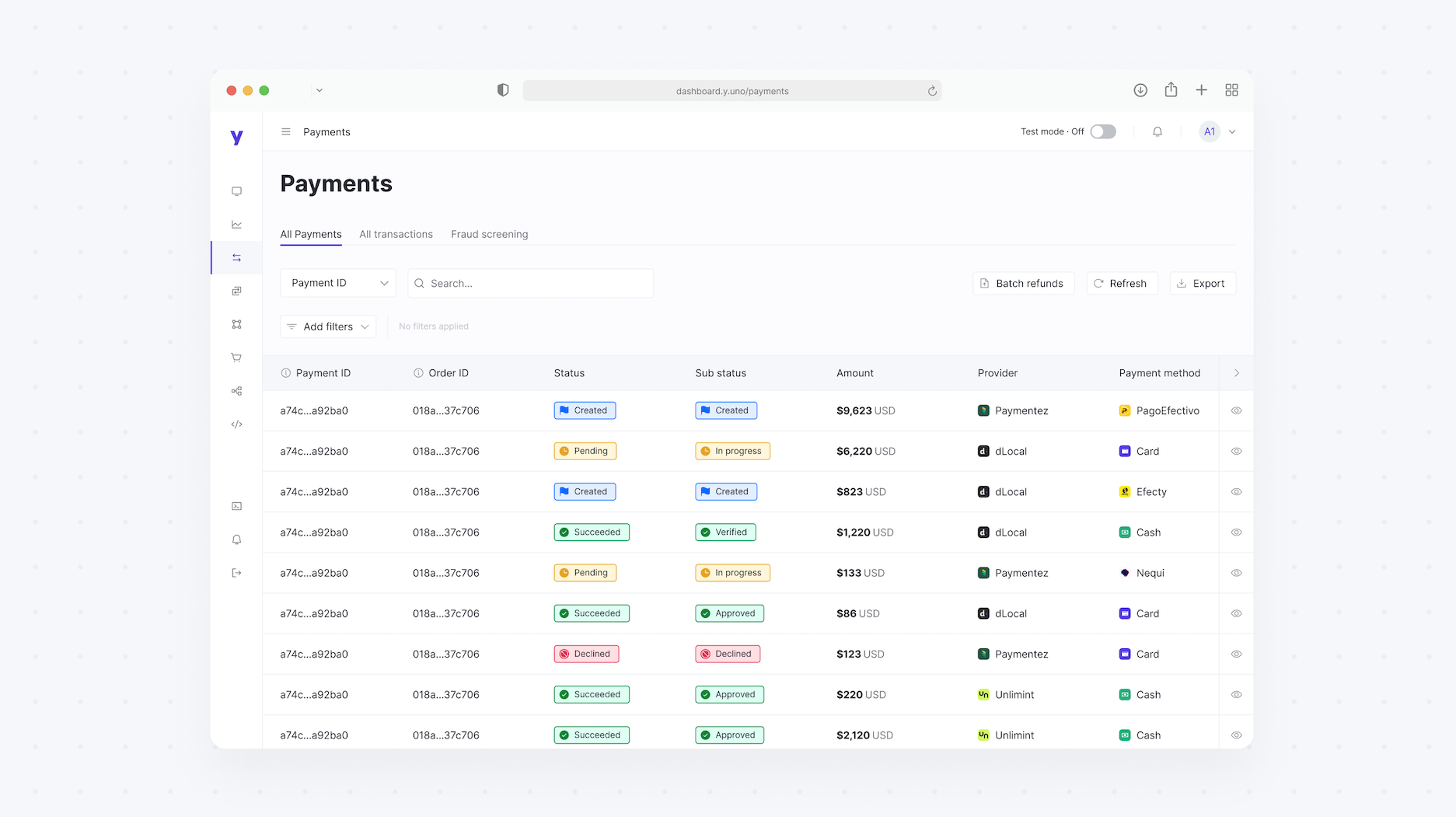

Those multinational companies typically use half a dozen payment providers, acquirers and banks to cover their needs worldwide, but Yuno says they only need one global payments orchestration provider. Payments orchestration is a way to integrate all of those payment providers and financial institutions into a single layer to replace the individual services tech global companies already use to facilitate each payment conversion. The company launched its product in October 2022 to provide a wide array of payment methods — over 300, actually — with fraud-detection capabilities, one-click checkout and advanced smart routing technology.

TechCrunch covered the Colombian payments startup when it was newly formed and raised $10 million from some heavy-hitter investors, including Andreessen Horowitz. Today, Yuno has facilitated transactions in over 40 countries worldwide and is working with enterprise clients like McDonald’s, Rappi, Avianca and inDrive.

The global payments orchestration market is forecasted to reach nearly $7 billion in value by 2032. In Latin America, in particular, merchants trying to cater to customers in other countries have to figure out how to collect different currencies and from customers who don’t have credit cards.

The potential opportunity has attracted companies all over the world that hope to grab a piece of that pie, like Gr4vy, Plug and Revio. Similar to Yuno grabbing capital from top investors, Simetrik, also based in Colombia, is developing a payments infrastructure and is now backed by Goldman Sachs.

Many of Yuno’s competitors focus on solving payment orchestration for small and medium businesses, and not many were building the infrastructure for large enterprises, Ortega says.

“We are one of the few orchestrators that actually have integrations around the world,” Ortega said. “Today we have more than 150 integrations that enable companies to access payment methods that require payment processors in all the different continents.”

With founders hailing from Colombian unicorn Rappi, payments startup Yuno raises $10M from a16z and LatAm VCs

In the past year, Yuno caught the eye of leading investment company DST Global Partners, which put together a recent $25 million Series A injection into the company. DST was joined by Andreessen Horowitz, Tiger Global, Kaszek Ventures and Monashees. That new round of capital gives Yuno a valuation of $150 million, Ortega said.

The funding will be used to solidify Yuno’s presence in Asia, Europe and Africa and also to keep investing in building its payment infrastructure orchestration platform.

“We are going to keep building our sales, product and technology teams through much of the first quarter,” Ortega said. “In addition to Latin America, we also have offices in New York and Singapore, so having more presence in those markets will be key for this year.”

For LatAm payment orchestration startups, market fragmentation is a blessing in disguise