Image: YNAB

Image: YNAB

At a Glance

At a Glance

Expert’s Rating

Pros

Simple, intuitive budget creationSyncs with online bank accountsIntegrated philosophy encourages financial responsibility

Cons

Not a great option for investment accounts

Our Verdict

Backed by its four-rule philosophy, YNAB doesn’t just track your finances, it also teaches you to be a better money manager.

Price When Reviewed

$11.99 per month, $84 per year

Best Prices Today: YNAB (You Need a Budget)

RetailerPriceYNAB$84View DealPrice comparison from over 24,000 stores worldwideProductPricePrice comparison from Backmarket

As you can tell by its name, YNAB (You Need a Budget) makes no bones about the fact you need to manage your money rather than the other way around. The popular program, which started life more than a decade ago as manual-input desktop software, is now a subscription-based web app that can sync with your financial accounts.

Note: This review is part of our roundup of the best budgeting software. Go there for details about competing products and how we tested them.

Despite some cosmetic changes over the years, YNAB still adheres to its four founding principles:

1) Give every dollar a job—Each dollar that comes into your life should be allocated to a specific purpose: to pay your rent or mortgage, to fund your retirement, even to buy that latte that helps get you through your morning commute. By telling your money where to go and what to do, you discipline your spending.

2) Embrace your true expenses—It’s easy to see your monthly bills coming. What typically derails a budget are the less frequent ones, like annual insurance premiums and subscriptions, birthdays and holidays, and your kids’ seasonal sports fees. YNAB proposes you budget for these expenses monthly to even out your cash flow over the year and avoid taking big budget hits during certain months.

You Need a Budget

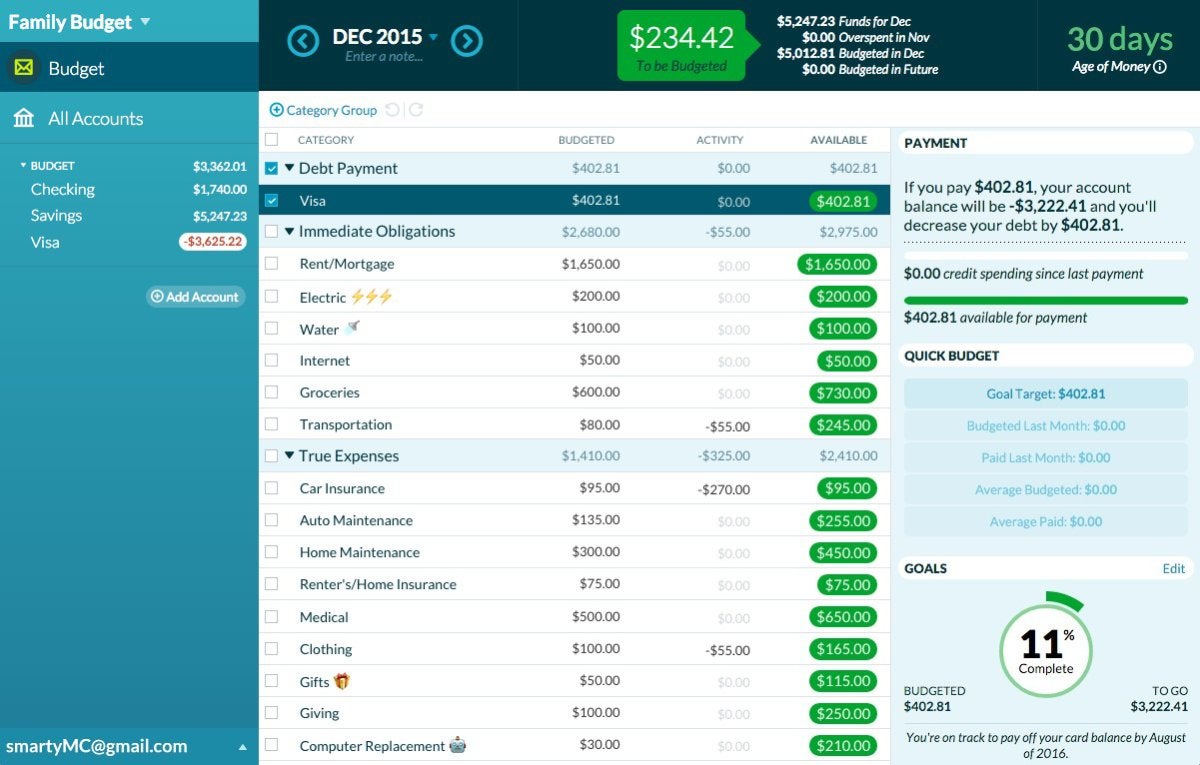

You Need a BudgetYNAB lets you allocate every dollar in hand to specific spending and saving categories.

3) Roll with the punches—No matter how well you plan, your budget will inevitably run head first into unforeseen expenses. YNAB allows you to be nimble and easily move money from a budgeted category to cover unbudgeted spending and stay out of the red.

4) Age your money—Timing your bills with your paychecks is about as easy as aligning the planets. Ideally, you should shoot to live this month on last month’s income. It’s a lofty goal, but as YNAB says it will keep you “living far, far away from the financial edge.”

YNAB makes it easy to live by these rules with its category-based interface. You can choose to direct import transactions from your bank or enter them manually. In either case, any inflow of money is tagged “to be budgeted” and from this sum you can allocate amounts to your spending and saving categories. As you download/enter transactions, the amounts are deducted from their respective category balances.

Michael Ansaldo/IDG

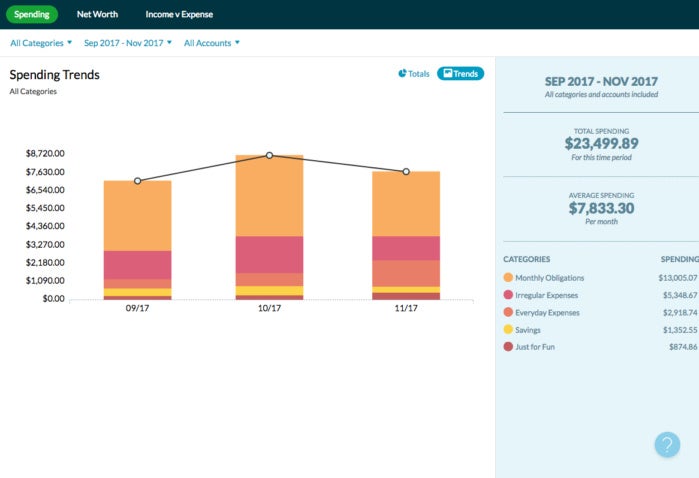

Michael Ansaldo/IDGYNAB can generate reports on spending trends and other activity.

If you have an unexpected expense in a category you didn’t budget for, you can move funds from a budgeted category by clicking on it and sending the amount where it’s needed. YNAB highlights any over-budgeting in red in the offending categories as a vivid reminder to re-allocate dollars and get your budget balance back to zero.

YNAB includes customizable reports that break down your income and expenses by category, account, and time frame. Its greatest strength, however, is its huge community of devout users who freely share their tips on the app as well as the larger enterprise of personal budgeting. The home site is also rich with support resources ranging from help docs to weekly videos to podcasts, all with the aim of helping you get and keep your finances in order.

YNAB offers a free 34-day trial that converts to a $6.99-per-month subscription.

Bottom line

The mechanics of YNABs interface really creates the sense that you’re controlling your money rather than just tracking it as it flows in and out of your accounts. In that, it goes beyond just a mere budgeting tool and actually helps improve your money habits. Whether you’re pulling down a steady paycheck or paid on an irregular timetable, YNAB will help you make the most of every dollar.

Best Prices Today: YNAB (You Need a Budget)

RetailerPriceYNAB$84View DealPrice comparison from over 24,000 stores worldwideProductPricePrice comparison from Backmarket