Paris-based startup Pigment has raised a $145 million funding round just five years after its inception. The enterprise software company offers a business planning platform for large companies to visualize their past financial performance and forecast upcoming quarters.

This funding round comes as a bit of a surprise as large rounds have been few and far between in France. According to a recent study from EY, funding rounds in the French tech ecosystem were down 38% in 2023 compared to 2022.

But if you remove buzzy AI startups like Mistral AI and capital-intensive infrastructure plays that are not really tech startups, like EV charging networks (Driveco) and EV battery factories (Verkor), funding rounds are drastically down. Pure software startups have had a rough couple of years.

Pigment appears as an exception with its Series D. Existing investor Iconiq Growth is doubling down by leading this new funding round. Sandberg Bernthal Venture Partners, IVP, Meritech, Greenoaks and Felix Capital are also participating — many of them were existing investors too.

And there’s a reason why Pigment managed to raise so much at a significantly higher valuation less than a year after its previous funding round. In 2023, the startup managed to triple its revenue and double its customer base with well-known clients like Unilever, Datadog, Kayak and Merck. Half of Pigment’s clients are based in the U.S.

“Our current investors told us ‘if you’re going to raise money in 18 months to scale with others, we might as well offer you great terms right now for an internal round.’ And everything happened very quickly … In one week, it was a done deal,” co-founder and co-CEO Eléonore Crespo told me.

Before Pigment, Crespo worked for VC firm Index Ventures and Google. She co-founded Pigment with Romain Niccoli, who was the co-founder and CTO of adtech startup Criteo — an early success of the French tech ecosystem.

“IVP — one of our backers — benchmarks the growth rate of all SaaS companies. And since we’ve been selling our product, we’ve been in the top 5% of SaaS companies with the best growth rate ever, in terms of revenue growth,” Crespo said.

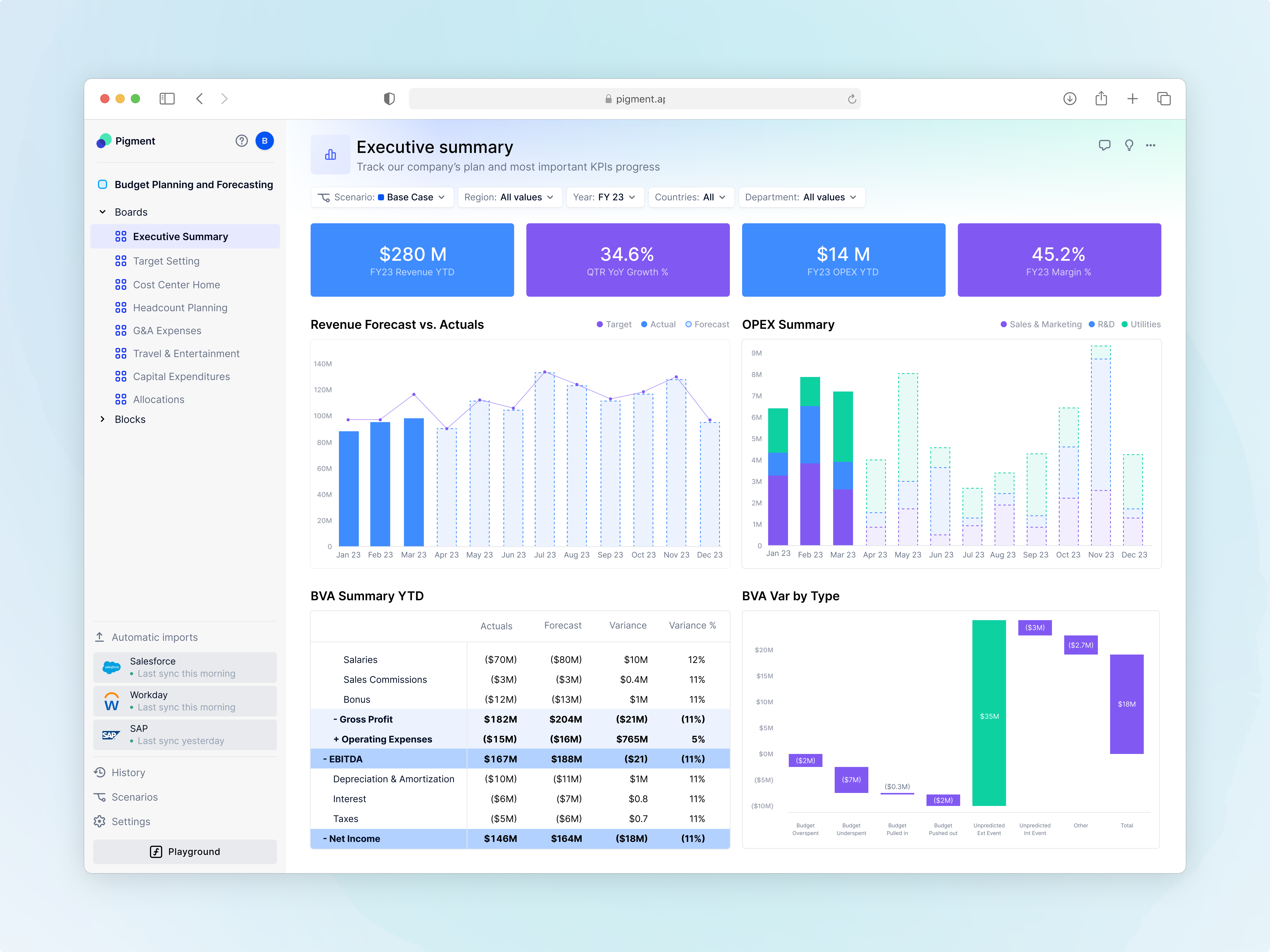

Pigment is a flexible business planning tool that is used by chief financial officers and finance teams to create reports and budgets. It’s a modern SaaS platform, meaning that you can integrate it with all your company’s data (ERP, HRIS, data lakes, etc.) and use it as a collaboration tool.

In addition to finance teams, sales teams can use Pigment to create quotas and see how everyone is performing against quarterly quotas. HR teams can see how they should scale the workforce up and down based on strategic changes and financial objectives.

“We’ve done a lot of work to address other teams, not just finance teams. We’ve developed a lot of modules that enable us to serve HR teams, supply chain teams and sales teams,” Crespo said.

In fact, as more teams start using Pigment, it becomes an important tool for cross-team collaboration. And it’s supposed to work better than legacy tools from Oracle and SAP.

Like many software companies, Pigment has also added AI features. As Pigment acts as the central repository for all the important metrics of a company, customers can ask questions to Pigment AI in natural language to get a quick answer. Examples include “Can you give me a breakdown of revenue per country?” or “Why was our actual revenue lower than our forecast last quarter for this product?”

But more importantly, the company has optimized its core product so that it works well even with large datasets and complicated calculations. The best enterprise software products are must-have products, which means that companies usually don’t need to spend a lot of resources on improving the product — clients need this tool to operate. Pigment is still the challenger in this industry, so it believes it needs to provide a better product to compete with other business planning products.