Byju’s, once valued at $22 billion, is willing to cut its valuation to below $2 billion as it hunts for new funding, a person familiar with the matter told TechCrunch.

The Bengaluru-headquartered startup, once India’s most valuable, is looking to raise $100 million to $200 million in new funding via a rights issue, according to two people familiar with the matter. The edtech group’s chief executive and co-founder Byju Raveendran is likely to invest in the new funding, a source with direct knowledge of the matter said, requesting anonymity as the matter is private and the rights issue hasn’t yet launched. Byju’s plans to dilute about 10% in the new rights issue, implying the valuation may hit as low as $1 billion.

Byju’s willingness to cut the valuation is a stunning reversal of fortune for the startup, once the poster child of the Indian startup ecosystem. The startup, which spent more than $2.5 billion in 2021 and 2022 acquiring over half a dozen firms globally, was once showered a valuation as high as $50 billion by marquee investment bankers, TechCrunch earlier reported.

A Byju’s spokesperson declined to comment.

Byju’s has been chasing for new funding for nearly a year. The startup was in final stages to raise about $1 billion last year, but the talks derailed after the auditor Deloitte and three key board members quit the startup. Instead, Byju’s ended up raising less than $150 million in that round from Davidson Kempner and had to repay the investor the full committed amount after making a technical default in a separate $1.2 billion term loan B.

The new funding deliberation follows BlackRock cutting the value of its holding in Byju’s, slashing the implied valuation of the Indian startup to about $1 billion, according to disclosures made by the asset manager.

Byju’s was preparing to go public in early 2022 through a SPAC deal that would have valued the company at up to $40 billion. However, Russia’s invasion of Ukraine in February sent markets downward, forcing Byju’s to put its IPO plans on hold, according to a source familiar with the matter. As market conditions worsened, so too did the business outlook for Byju’s. The company began facing mounting pressure from investors to address issues that it had previously left unresolved.

The startup has been backed by over a dozen movers and shakers in the industry, from Peak XV Partners to Lightspeed, UBS and Chan Zuckerberg Initiative. Byju’s, which gained initial popularity in India because its tutors used intuitive ways — tackling complex concepts using real-life objects such as pizza and cake — has raised over $5 billion in equity and debt in the past decade.

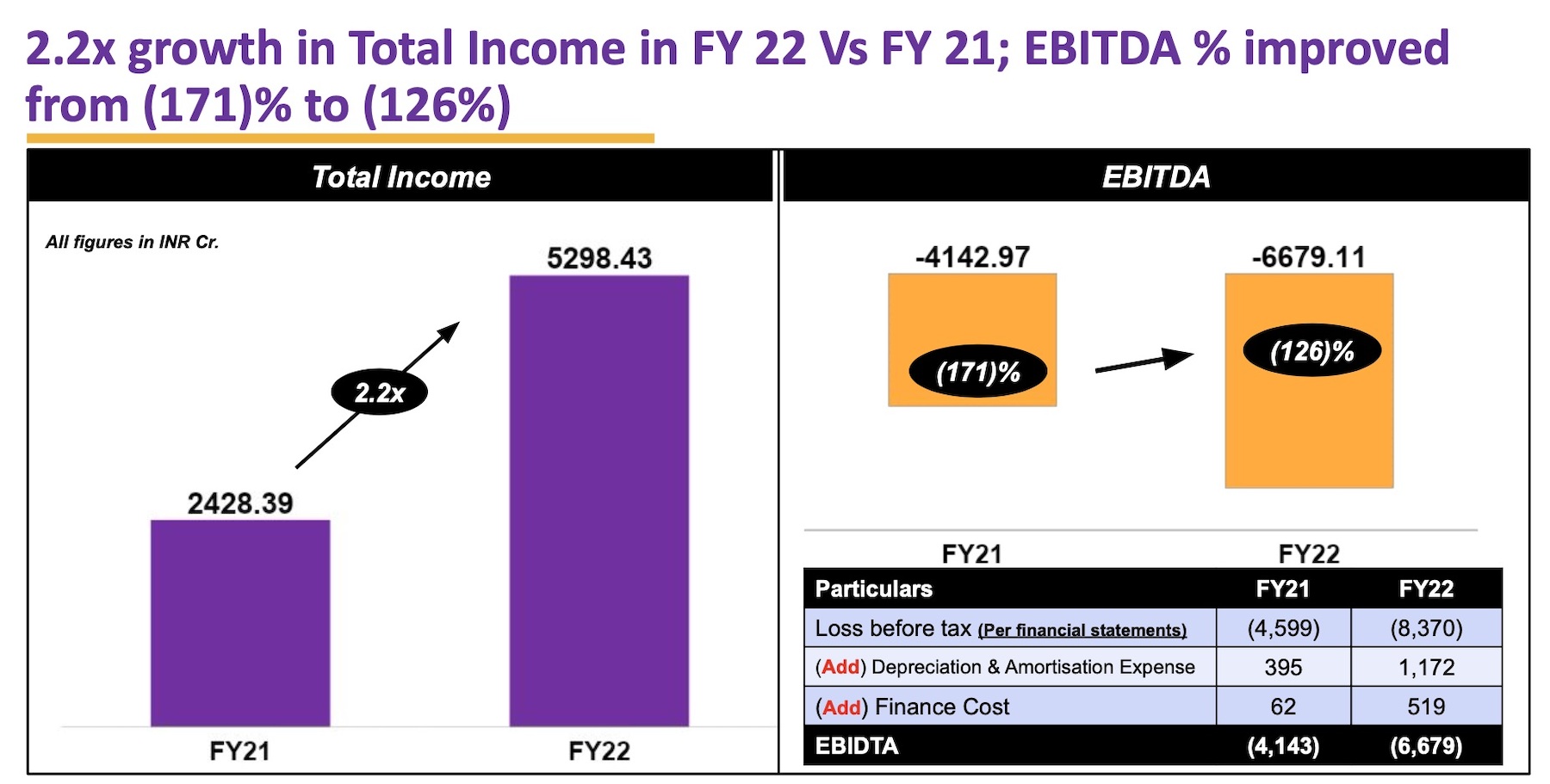

Byju’s today is reeling from a series of challenges: It’s struggling to raise capital, make payroll and pay off its billion-plus debt. It missed its revenue target for the financial year ending in March 2022, the startup disclosed in a much-delayed account last month. Prosus publicly slammed the Bengaluru-headquartered startup in July for not evolving sufficiently and disregarding the investor’s advice and recommendations despite repeated attempts.