A new report highlights the demand for startups building open source tools and technologies for the snowballing AI revolution, with the adjacent data infrastructure vertical also heating up.

Runa Capital, a venture capital (VC) firm that left Silicon Valley and moved its HQ to Luxembourg in 2022, has published the Runa Open Source Startup (ROSS) Index for the past four years, shining a light on the fastest-growing commercial open source software (COSS) startups. The company publishes quarterly updates, but last year it produced its first annual report, taking a top-down view of the whole of 2022 — something it’s repeating now for 2023.

Trends

Data is closely aligned with AI because AI relies on data for learning and making predictions, and this requires infrastructure to manage the collection, storage, and processing of that data. And these tangential trends collided in this report.

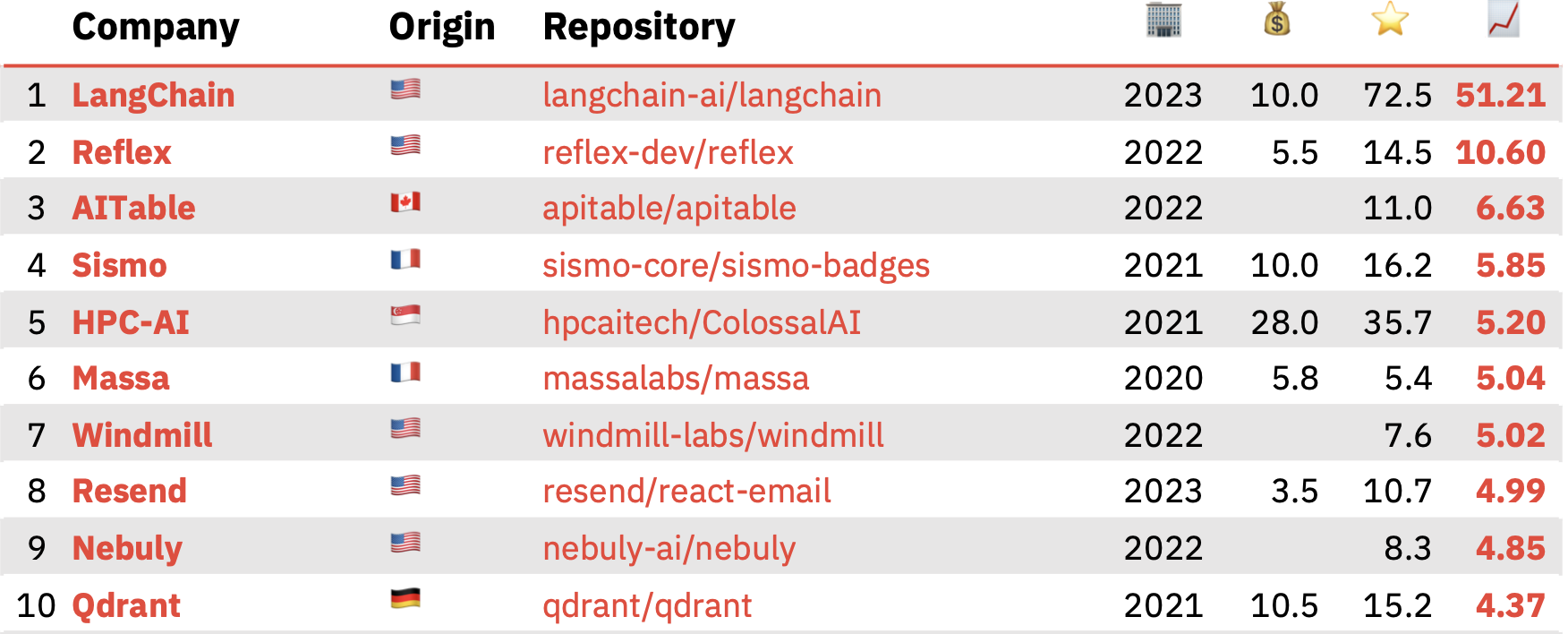

Hitting top-spot in the ROSS Index for last year was LangChain, a two-year-old San Francisco–based startup that has developed an open source framework for building apps based on large language models (LLMs). The company’s main project passed 72,500 stars in 2023, with Sequoia going on to lead a $25 million Series A round into LangChain just last month.

Elsewhere in the top 10 is Reflex, an open source framework for creating web apps in pure Python, with the company behind the product recently securing a $5 million seed investment; AITable, a spreadsheet-based AI chatbot builder and something akin to an open source Airtable competitor; Sismo, a privacy-focused platform that allows users to selectively disclose personal data to applications; HPC-AI, which is building a distributed AI development and deployment platform in a push to become something like the OpenAI of Southeast Asia; and open source vector database Qdrant, which recently secured $28 million to capitalize on the burgeoning AI revolution.

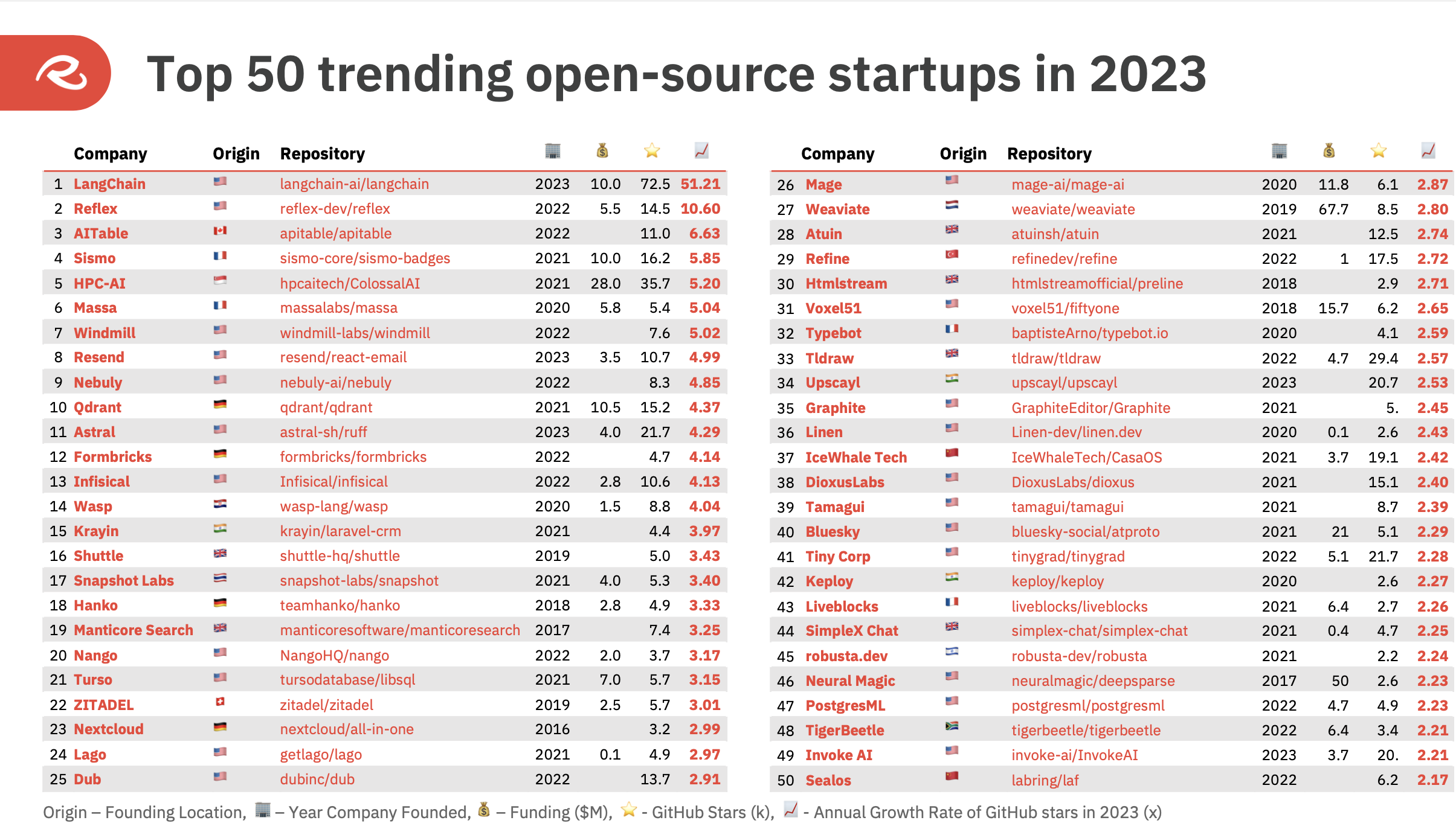

A broader look at the “top 50 trending” open source startups last year reveals that more than half (26) are related to AI and data infrastructure.

It’s difficult to properly compare the 2023 index with the previous year from a vertical perspective, due largely to the fact that businesses often pivot or change their product positioning to suit what’s hot today. With the ChatGPT hype train going full throttle last year, this may have led earlier-stage startups to alter their focus, or even just place greater emphasis on the existing “AI” element of their product.

But as generative AI’s breakthrough year, it’s easy to see why demand for open source componentry might skyrocket, as companies of all sizes look to keep apace with proprietary AI juggernauts such as OpenAI, Microsoft, and Google.

Geographies

Open source software has also always been very distributed, with developers from all over the world contributing. This ethos often translates into commercial open source startups that might not have a traditional center of gravity anchored by a brick-and-mortar HQ.

However, the ROSS Index goes some way toward bringing geography into the picture, reporting that 26 companies on the list have an HQ in the U.S., though 10 of these companies originated elsewhere and still have founders or employees based in other locales.

In total, the top 50 hailed from 17 separate countries, with 23 of the companies incorporated in Europe — a 20% rise on the previous year’s index. France counted the most COSS startups with seven, including Sismo and Massa, which are in the top 10, while the U.K. soared from just one startup in 2022 to six in 2023, placing it in second place from a European perspective.

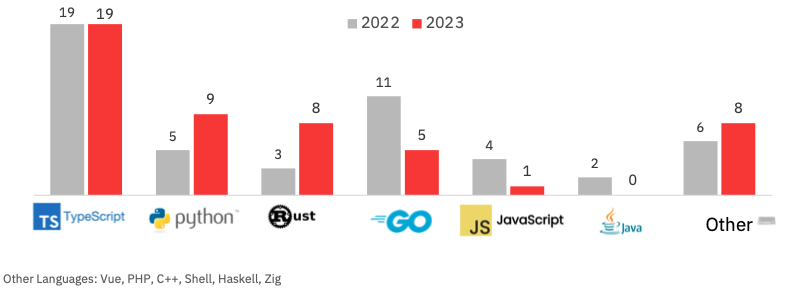

Other notable tidbits to emerge from the report include programming languages — the ROSS Index recorded 12 languages used by the top 50 last year, versus 10 in 2022. But TypeScript, a JavaScript superset developed by Microsoft, remained the most popular, used by 38% of the top 50 startups. Both Python and Rust grew in popularity, with Go and JavaScript dropping.

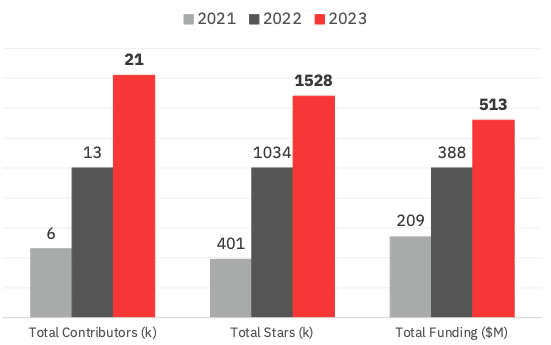

The top 50 ROSS Index participants collectively gained 12,000 contributors in 2023, while the overall GitHub star-count increased by nearly 500,000. The index also reveals that funding into the top 50 COSS startups last year hit $513 million, an increase of 32% on 2022 and 145% on 2021.

Methodology and context

It’s worth looking at the methodology behind all this — what factors influence whether a company is considered “top trending”? For starters, all companies included must have at least 1,000 GitHub stars (a GitHub metric similar to a “like” in social media) to be considered. But star-count alone doesn’t tell us much about what’s trending, given that stars are accumulated over time — so a project that has been on GitHub for 10 years is likely to have accumulated more stars than one that has existed for 10 months. Instead, Runa measures the relative growth of the stars over a given period using an annualized growth rate (AGR) — this looks at the star value now versus a previous corresponding period to see what has grown most impressively.

A degree of manual curation is involved here, too, given that the goal is to eke out open source “startups” specifically — so the Runa investment team pulls out projects that belong to a “product-focused commercial organization,” and it has to have been founded fewer than 10 years ago with less than $100 million in known funding.

Defining what constitutes “open source” has its own inherent challenges, too, as there is a spectrum of how “open source” a startup is — some are more akin to “open core,” where most of their major features are locked behind a premium paywall, and some have licenses that are more restrictive than others. So for this, the curators at Runa decided that the startup must simply have a product that is “reasonably connected to its open-source [repositories],” which obviously involves a degree of subjectivity when deciding which ones make the cut.

There are further nuances at play too. The ROSS Index adopts a particularly liberal interpretation of “open source” — for example, both Elastic and MongoDB abandoned their open source roots for licenses that are “source available,” to protect themselves from being taken advantage of by the major cloud providers. According to the ROSS Index’s methodology, both these companies would qualify as “open source” — even though their licenses are not formally approved as such by the Open Source Initiative, and these specific example companies no longer refer to themselves as “open source.”

Thus, according to Runa’s methodology, it uses what it calls the “commercial perception of open-source” for its report, rather than the actual license the company attaches to its project. This means that restricted source-available licenses like BSL (business source license) and SSPL (server side public license), which MongoDB introduced as part of its transition away from open source in 2018, are very much on the menu as far as commercial companies in the ROSS Index are concerned.

“Such licenses maintain the OSS spirit — all its freedoms, except for slightly limited redistribution, which does not affect developers but grants original vendors a long-term competitive edge,” Konstantin Vinogradov, Runa Capital’s London-based general partner, explained to TechCrunch. “From a VC perspective, it is just an evolved playbook for exactly the same type of companies. The open source definition applies to software products, not companies.”

There are other notable filters in place too. For instance, companies that are mostly focused on providing professional services, or side projects with limited active support or with no commercial element, are not included in the ROSS Index.

For comparative purposes, there are other indexes and lists out there that give a steer on the “whats hot” in the open source landscape. Another VC firm called Two Sigma Ventures maintains the Open Source Index, for instance, which is similar in concept to Runa’s, except it spans all manner of open source projects (not just startups) and has additional filters in place, including the ability to view by GitHub’s “watchers” metric, which some argue gives a more accurate picture of a project’s true popularity.

GitHub itself also publishes a trending repositories page, which, similar to Two Sigma Ventures, doesn’t focus on the business behind the project.

So the ROSS Index has emerged as a useful complementary tool for figuring out which open source “startups” specifically are worth keeping tabs on.