Venture debt has its merits. It can be a better and cheaper alternative to raising equity, especially if you are building a company in a capital intensive industry. However, lately, some people don’t seem to be fans.

People can diss hard on venture debt, especially following the Silicon Valley Bank troubles in early 2023, as my colleague Anna Heim noted while recapping a TechCrunch Disrupt 2023 panel.

That’s why it’s interesting that startup finance company Arc Technologies is choosing now to take on the $30 billion venture debt industry with a venture debt marketplace for Silicon Valley. Arc was founded in 2021 and has raised around $180 million in equity and debt funding, most recently a $20 million Series A round in 2022.

YC-backed Arc, a digital bank for ‘high-growth’ SaaS startups, lands $20M Series A

Don Muir, co-founder and CEO of the San Francisco-based company, was candid when he told TechCrunch that “venture debt isn’t for everyone.”

“In 2021, you could snap your fingers and raise a $50 million equity round with no customers and no revenue,” Muir said. “That doesn’t exist anymore. Today, equity and debt investors care about fundamentals. There’s a larger pool of debt capital that’s now available to these companies because they’re stronger and more resilient. And the value prop of debt, which is much less expensive than equity, is relatively more attractive.”

When Silicon Valley Bank was having its moment, a number of companies, like Brex, family offices, credit funds and new banks, quickly stepped up to provide opportunity for alternative capital. Muir notes that all that activity made it difficult for startups to know the best place to go.

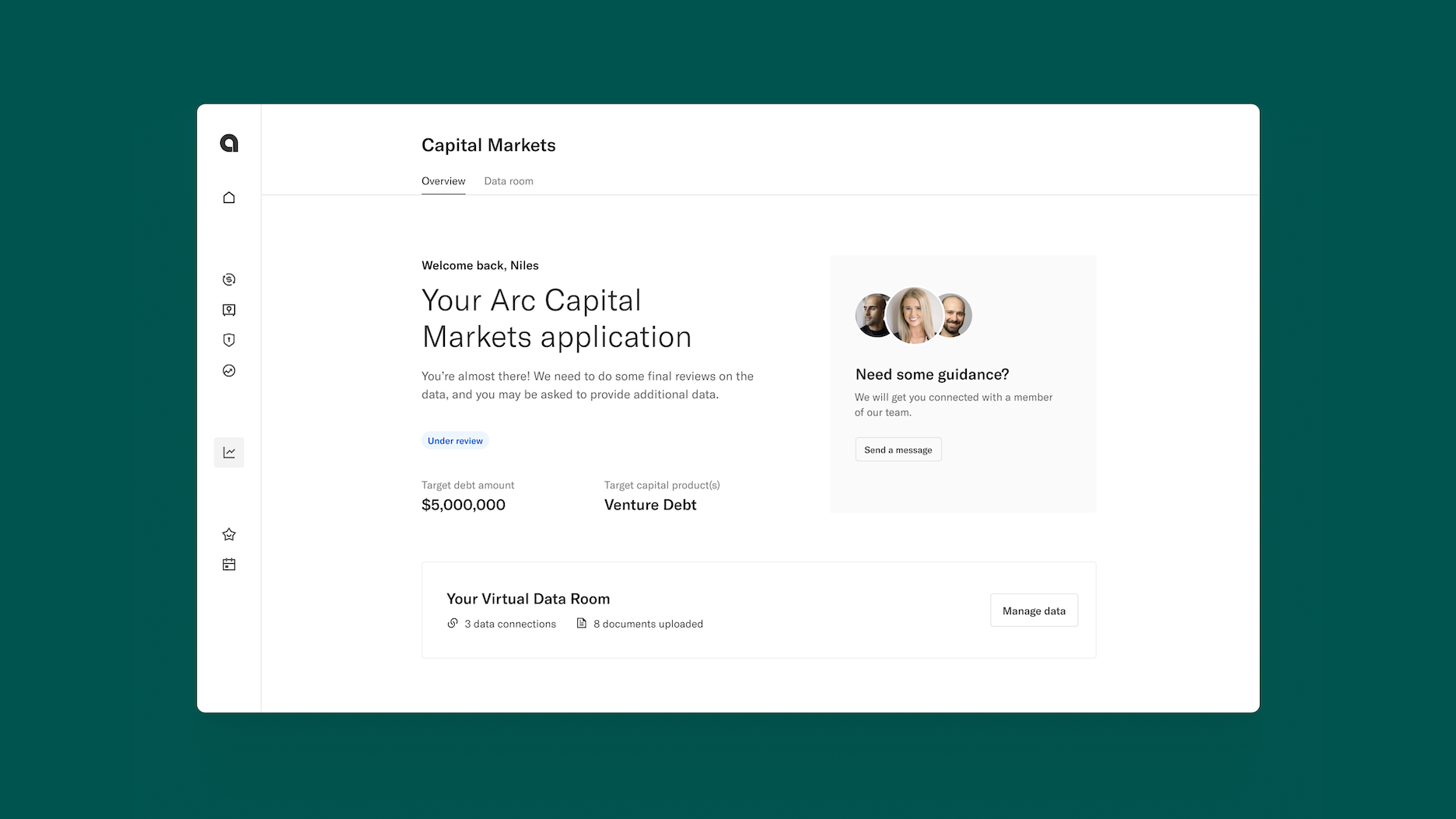

That’s what Arc is solving with its Arc Capital Markets debt marketplace. In 10 minutes, companies can onboard into Arc Capital Markets and receive indicative debt terms for up to $250 million within five days from a network of lenders.

The company’s underwriting model takes in historical financial data points and then pre-qualifies startups and makes a lender match based on what the startup is qualified for, financial health and profile. Arc touts it can save companies months and thousands in fees with its marketplace as there is no cost for startups to receive funding terms.

Brex CEO is trying to raise over $1B in a weekend for SVB-related bridge loans

“Based on the credit metrics that we calculate through our underwriting algorithm, we know that business is well suited, for example, for a term loan from one of our middle-market lenders,” Muir said. “We can also identify the five top lenders who are, most likely in the shortest period of time, to put forward indicative terms for that business.”

Though it’s still early, Arc’s platform seems to be doing well. More than 350 transactions have closed thus far with nearly $100 billion in available assets under management.

Coming up, the company intends to build additional banking products and lender experiences, including a new product, that Muir declined to speak to right now, in the first half of 2024.

“A much larger swath of venture-backed tech companies are looking at venture debt today than just a few years ago and we’re here to make that market,” Muir said. “We want to help founders and CFOs weather the ongoing storm in the venture capital funding route and ensure that they’re continuing to grow efficiently with minimal dilution.”

Taking another look at venture debt