The National Payments Corporation of India (NPCI), the body overseeing the country’s widely used Unified Payments Interface (UPI) mobile payment system, is going to meet various fintech startups this month to develop a strategy to address the growing market dominance of PhonePe and Google Pay in the UPI ecosystem, sources familiar with the matter told TechCrunch.

NPCI executives plan to meet with representatives from CRED, Flipkart, FamPay and Amazon, among other players, to discuss key initiatives aimed at boosting UPI transactions on their respective apps, and to understand the assistance they require, the sources said.

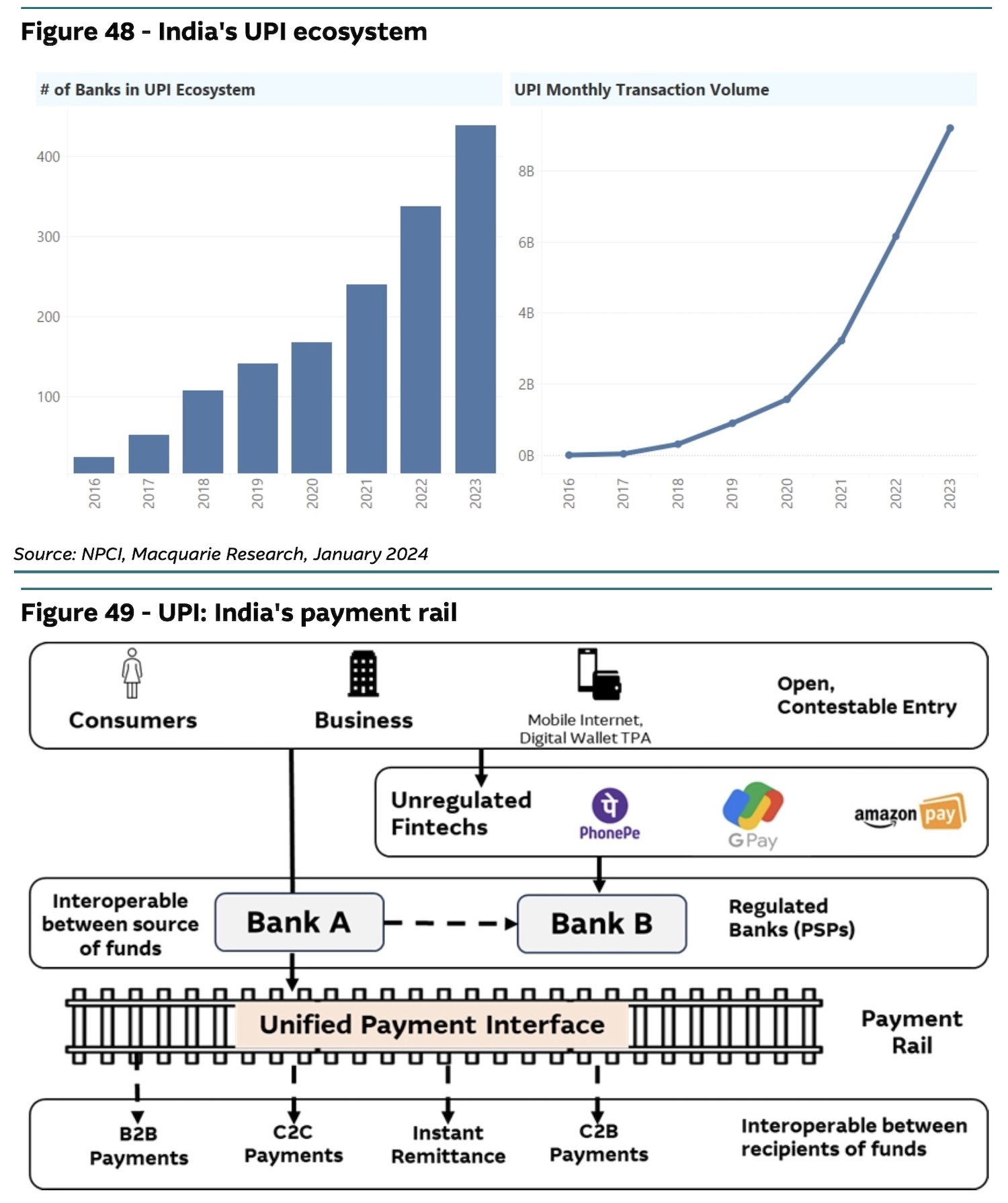

UPI, built by a coalition of Indian banks, has become the most popular way Indians transact online, and the system is said to process more than 10 billion transactions a month.

These new meetings are part of a growing effort to address concerns raised by lawmakers and industry players about the market dominance of Google Pay and PhonePe, which together account for nearly 86% of UPI transactions by volume (that’s up from 82.5% at the end of December). Walmart owns more than three-fourths of PhonePe.

Paytm, the third-largest UPI player, had by March 31 seen its market share decline to 9.1% from 13% at the end of 2023, following a clampdown by the Reserve Bank of India (RBI).

The conversation comes after the central bank expressed its “displeasure” to the NPCI over the growing duopoly in the payments space, a person familiar with the matter said. An NPCI spokesperson declined to comment.

In February, a parliamentary panel urged the Indian government to support the growth of domestic fintech players that can offer alternatives to PhonePe and Google Pay.

The NPCI has long sought to limit the market share of individual UPI service providers to 30%. However, the body late last year extended the deadline for firms to comply with this directive to the end of December 2024. The organization faces a unique challenge in enforcing this directive: It believes that it currently lacks the technical mechanism to do so.

India’s central bank is also weighing an incentive plan aimed at creating a more favorable competitive arena for emerging UPI players, another person familiar with the matter told TechCrunch. The Economic Times separately reported on Wednesday that the NPCI is encouraging fintech companies to offer incentives to users for making UPI transactions on their respective apps.