Image: AMD

Image: AMD

The PC CPU market set no new records for the second quarter of 2023, a researcher reports — and that’s all for the best.

Mercury Research reported that in the first quarter of 2023, CPU shipments within the PC market sunk to their lowest point in a decade. But in the second quarter, CPU sales soared by 20 percent quarter-over-quarter to where they’re expected to be — neither at the high nor low end of the scale, but somewhere in between. Another interesting wrinkle: Chromebook demand has begun surging again, according to Mercury principal analyst Dean McCarron.

McCarron didn’t provide overall shipment totals, reserving those for paid clients.

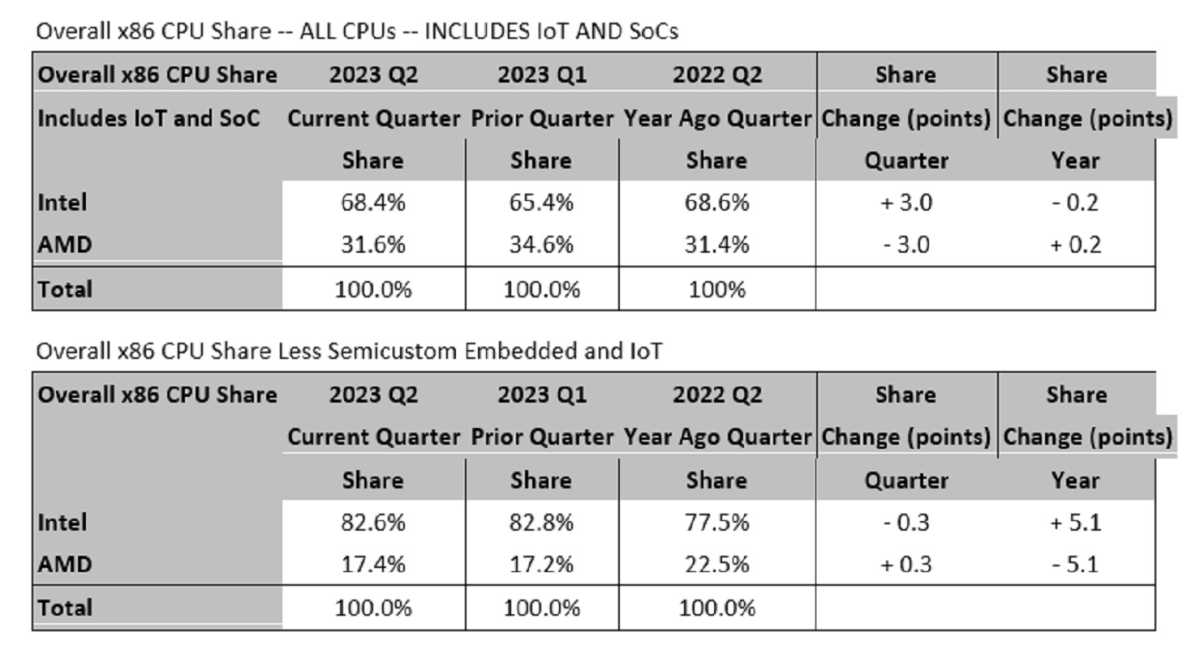

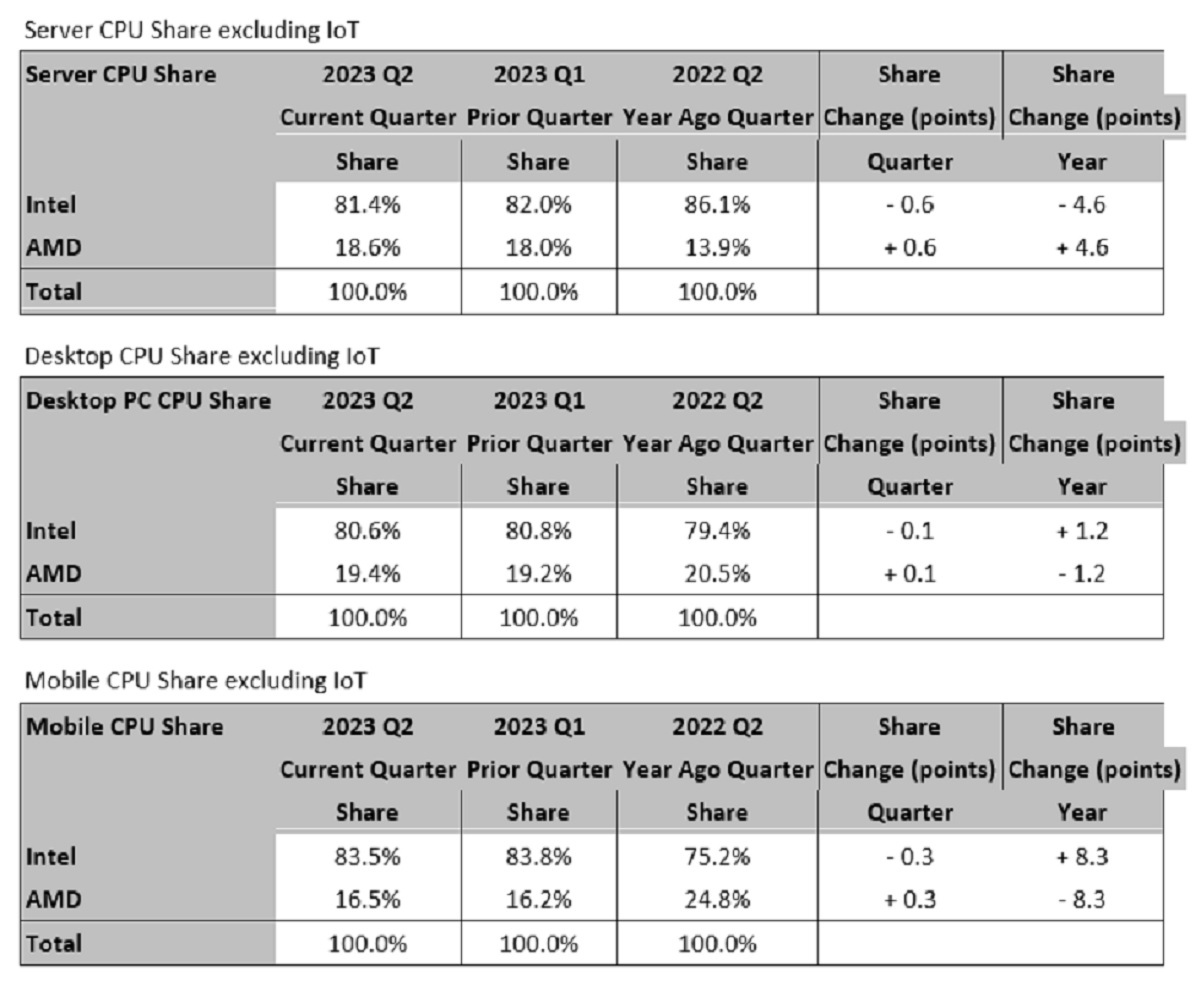

In the ongoing horse race between AMD and Intel, Intel won: the company gained 5.1 percentage points of market share during the quarter, if Internet of Things and embedded SOCs (which AMD sells into game consoles) were factored out. In desktop CPUs, Intel gained 1.2 percentage points; in mobile, Intel’s share soared by 8.1 percentage points.

McCarron cautioned, however, that his estimates come with some caveats. A major one: as the CPU market ramps back up again, any adjustments in share data are probably more likely due to retailers and other parts of the supply chain starting to come back to life — like a cold engine that sputters a bit before it catches.

Mercury Research

Mercury Research

Mercury Research

“Please keep in mind that due to the inventory corrections taking place, that the statistics and share movements reported here in the past few quarters — and likely for the first half of 2023 — are more reflective of the suppliers differing in the depth and timing of their inventory corrections, rather than indicating sales-out share of the PC market, which is something we probably won’t know with any accuracy until late in 2023,” McCarron wrote.

Intel saw sharp growth in low-end mobile processors, including Celeron and its new “Intel Processor” N-series chips, both of which go into Chromebooks, McCarron said. “[A] ll signs are after a year-long lull, Chromebook demand for CPUs–both X86 and ARM — has increased dramatically in the past two quarters,” McCarron said.

Apple’s declining Mac sales complicated matters somewhat, as a shortfall in Arm-based Macs helped lower the overall share of Arm CPUs in the PC market from 15.4 percent to 12.5 percent. If you factor in Arm CPU sales, “both AMD and Intel gained client share, with Intel in particular growing shipments in the Chromebook market far faster than ARM processors did,” McCarron said.

Mercury Research

Mercury Research

Mercury Research

Author: Mark Hachman, Senior Editor

As PCWorld’s senior editor, Mark focuses on Microsoft news and chip technology, among other beats. He has formerly written for PCMag, BYTE, Slashdot, eWEEK, and ReadWrite.

Recent stories by Mark Hachman:

No, Intel isn’t recommending baseline power profiles to fix crashing CPUsApple claims its M4 chip’s AI will obliterate PCs. Nah, not reallyIntel says manufacturing problems are hindering hot Core Ultra sales