When I was a student in the U.K., I remember that renting appliances like washing machines and televisions was the norm for some people, especially students living in short-term accommodations. Israeli startup Xyte (pronounced “excite”) has just raised $30 million, as it sees a return to this sort of hardware-as-a-service model to be the way forward for manufacturers whose margins are under constant pressure. If it works so well for software-as-a-service, why not hardware?

Xyte let me take a look at its 27-slide deck to see how it pulled it off. Was I excited by Xyte’s deck? Sadly, no. This 27-slide deck was short on the information that I would need as an investor to make an informed decision on whether or not to invest in it. Let’s break down what I saw.

We’re looking for more unique pitch decks to tear down, so if you want to submit your own, here’s how you can do that.

Slides in this deck

Xyte’s deck features 27 slides, some with redacted information. The redactions relate to its customers and trading figures, which is both fair enough and also makes it a bit trickier to get a picture of the full company.

Cover slideCompany overview, including some team detailsTeam slideOpportunity slideOpportunity 2 slideMarket slideProblem slideValue proposition slideSolution slide Solution 2 slide Solution 3 slide Dedicated interfaces slide Traction slide “Any industry, any size” slide (customer base) Value proposition slide Business transformation slide “Unique business and commerce platform” slide Customer study slide “Pioneering a new product category” slide “A single, integrated platform” slide Team 2 slide Interstitial slide Business model slide Go-to-market slide “Forecast and drivers” slide Investment summary slide Closing slide

Three Two things to love

You might think that with 27 slides, there would be plenty to pick from for the “three good things” section. Dear reader, I’m not gonna lie: Try as I might, I really struggled to find three good things about this deck.

So, let’s talk about the two sparks of brilliance I could spot in this inky void of despair:

Opening summary

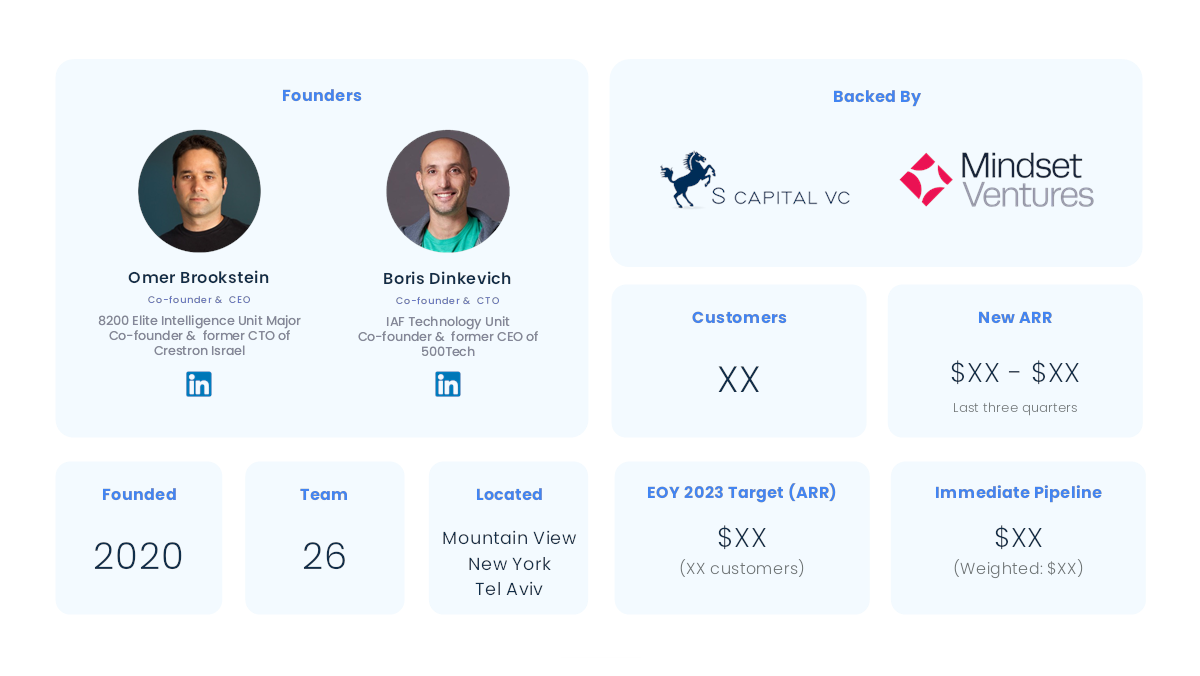

Xyte’s slide deck, overall, was a pretty underwhelming cavalcade of mediocrity. Still, I did really enjoy this one-slide summary right at the beginning.

Even with some of the core numbers redacted, it shows off a lot of important information at a glance that will likely get an investor to take note. In fact, I think this slide will become my recommended template for most startups raising money — it’s crisp, clear, and to the point, and it helps set the scene for what’s to come.

Pulling it all together

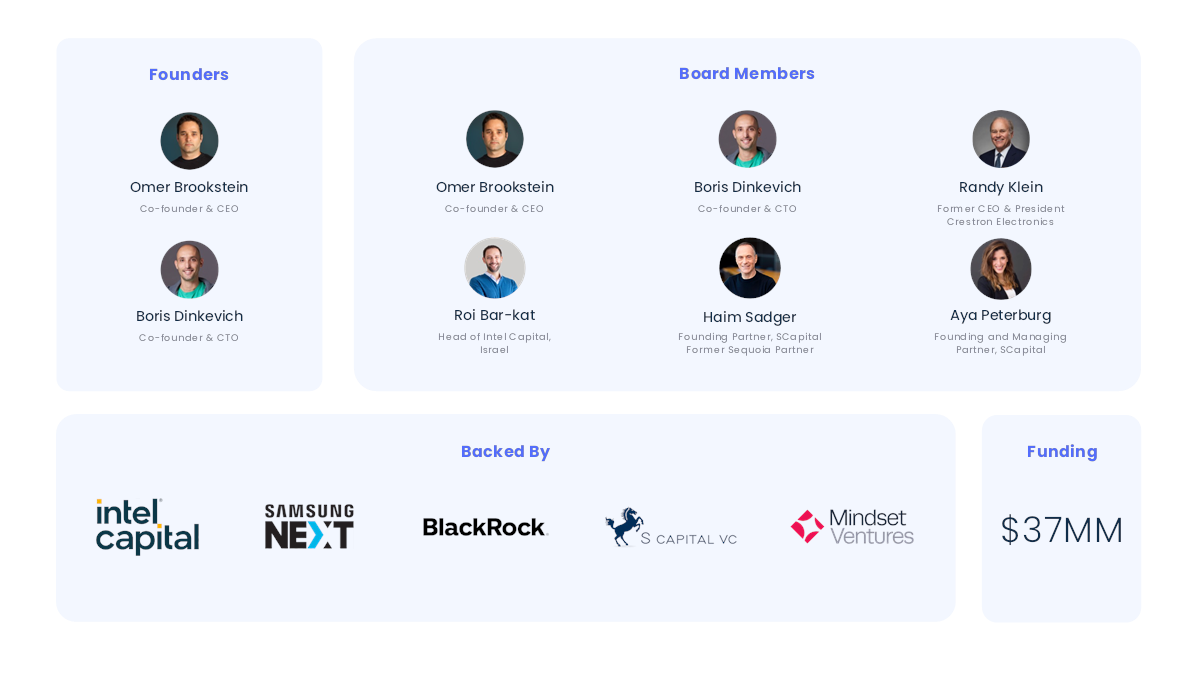

I have a lot of respect for summaries, and this deck pulled it off not once, but twice. The first one sets the stage, and the second one (below) summarizes the same story once more, but through the lens of an investor.

I really like the way the team did this. Illustrating that the company has figured out a problem and go-to-market strategy that makes sense is great. So good, in fact, that I’m going to look at each of these points separately:

Enormous opportunity: Yes! A startup has to reach “VC scale” in order to be investable at all. It might have been worth it to remind the investor of the actual market size here, but this slightly more abstract summary works well.Unique solution: Yes! Including a reminder of what you actually do is great.World-class product: I’d have loved to see this point backed by data, to be honest. Is it a world-class product? Maybe, but bring the receipts!Validated solution: Sure, but remember to include the why. What validates this solution? I suspect the point the company is truly trying to make here is related to the next point . . .Scalable GTM strategy: Being able to acquire customers at scale is what causes a startup to stop being a startup, and that’s a good thing. For bonus points, I’d have reminded the investors of the CAC:LTV ratio here, but it’s a damn fine start.Vision: Meh. This isn’t a reminder of the company’s vision, which is a missed opportunity. Perhaps, instead, it could have swapped in a team summary to remind the investors why this is the right team to build this company.

Minor tweaks aside, I think this “investment summary” slide does a lot of work, and I’m glad the team chose to include it.

In the rest of this teardown, we’ll look at three things Xyte could have improved or done differently, along with its full pitch deck!

Three things that could be improved

As you might have expected, the inverse of struggling to select three good things from 27 slides is an abundance of not-so-great slides. It wasn’t easy to choose, but here are some of the ones that really stood out.

The curse of the illustrative graph

I love a good graph. This isn’t one of them. Even with a heavily redacted slide without the actual milestones and axis information, this slide comes up short. I see these types of performative, illustrative graphs in decks quite a lot, and they are utterly meaningless.

If you’re going to chart data, chart real data. It’s never this smooth and predictable. These kinds of pretty, well-rounded charts just feel dishonest; I know you have better data than that. Use it, show it off. Don’t risk creating the impression that you’re trying to hide anything.

This split team slide needs to go

Somehow, slides 3 and 21 are both team slides. They are separated by almost a full pitch deck, but neither (individually or together) helps explain what an investor needs to understand.

I honestly don’t see the point of either of these slides because they don’t meet the sniff test for fundraising: The question you are trying to answer is, “Why is this the perfect team to back with $30 million?” A bunch of pictures with names and job titles isn’t going to cut it.

And then adding a slide similarly lacking in information, but of more junior staff (who your investors are absolutely going to give zero craps about), is just a waste.

Help me understand:

Why is this team inherently a part of your competitive advantage?Why would I be crazy to invest anywhere else?What skills and experience does this team have that nobody else does?

Neither of these slides helps tell that story, and it’s so easy to do a lot better.

The Team Slide is the most important slide in a startup pitch deck

That’s . . . not a go-to-market slide

If you’re going to be out there raising $30 million, I’d want to see a solid and detailed go-to-market plan based on data from existing sales and extrapolating that into the future. If you’re doubling your sales team, are you doubling your sales? Tripling it? If you spend 3x more on marketing, will that result in a proportional increase in revenue?

This slide is barely a functioning brainstorm.

A much better way to do it would be to cover some, or ideally, all of the below:

Target customers: It’s crucial to understand your target customers by conducting thorough market research. Analyze their behaviors, preferences, challenges and how they currently solve the problems your product aims to address. This enables you to tailor your product and messaging to meet their specific needs. It makes you a safer investment overall, too.Customer acquisition strategy: Expand on the tactics you will use to attract these customers. What’s the top of funnel (presumably a mix of digital marketing, content marketing, partnerships, and sales strategies)? Provide details on the platforms you will use and why they are effective for reaching your target market, with cost implications.Customer acquisition cost (CAC): Analyze your customer acquisition costs in depth by considering all associated expenses, including marketing, sales and any discounts or incentives. Benchmark these costs against industry averages and detail strategies to optimize and reduce CAC over time.Expansion and scalability: Discuss your expansion plans with a focus on how you will scale operations, technology and the team to support growth. Include potential challenges and how you plan to address them. Highlight pilot projects or market tests that validate your expansion strategy.Financial projections and metrics: Offer detailed financial projections that account for revenue growth, margin improvements and cash flow. Explain the assumptions behind your projections, such as market size, penetration rates and pricing strategy. Also, discuss the key performance indicators you will track to measure success and make informed decisions.

Incorporating these details into the pitch will demonstrate a comprehensive understanding of your business model, market, and growth strategy. And that, dear founders, is what a great go-to-market slide would look like.

The full pitch deck

If you want your own pitch deck teardown featured on TC+, here’s more information. Also, check out all our Pitch Deck Teardowns and other pitching advice, all collected in one handy place for you!