Even as quick commerce is slowly fading in many markets and several heavily funded startups have folded shop in the past two years, India is emerging as a striking outlier where the model — of delivering items to customers in 10 to 20 minutes — appears to be working.

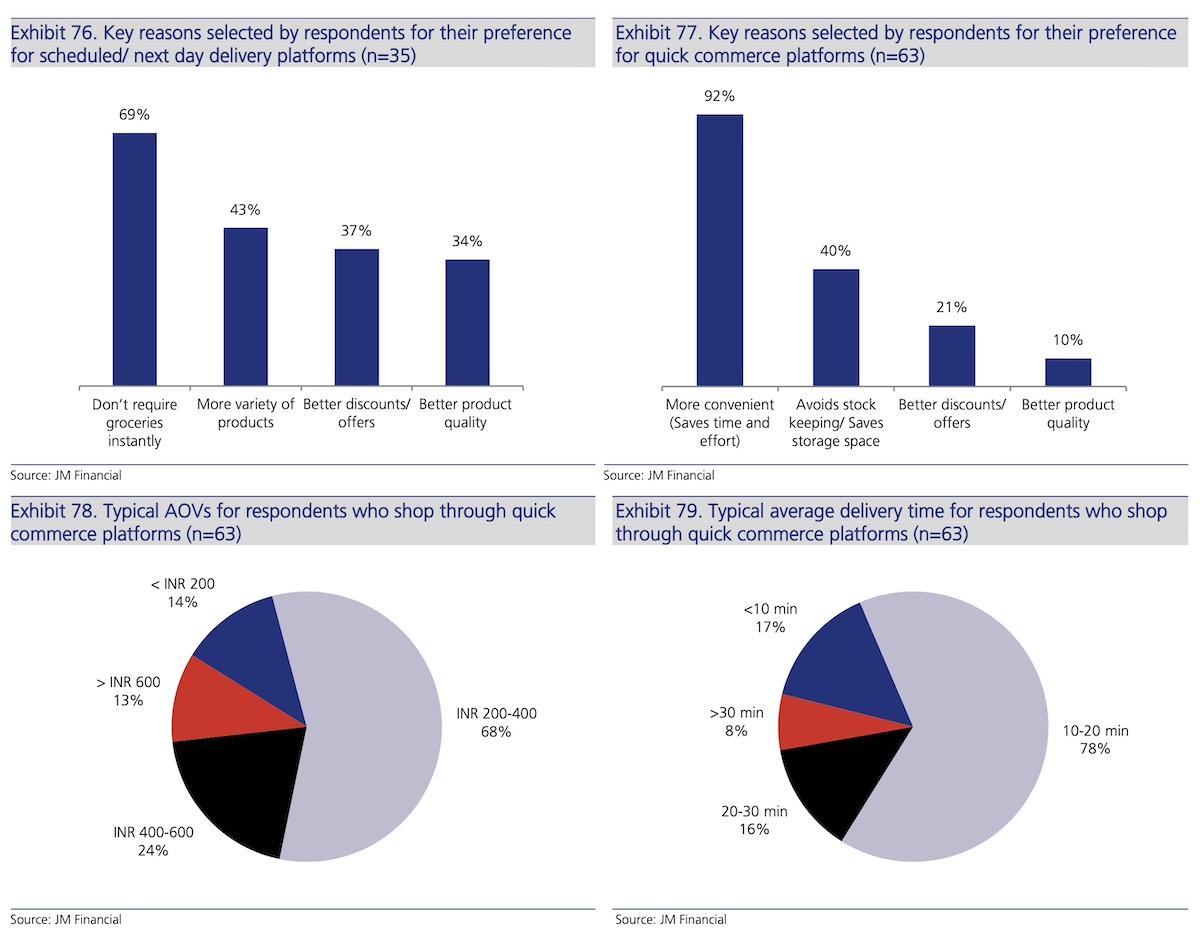

India’s quick commerce market has witnessed a staggering tenfold growth between 2021 and 2023, fueled by the sector’s ability to cater to the distinct needs of urban consumers seeking convenience for unplanned, small-ticket purchases. Despite this rapid expansion, however, quick commerce has only captured a modest 7% of the potential market, with a total addressable market (TAM) estimated at $45 billion, surpassing that of food delivery, according to JM Financial.

The quick commerce players — Zomato-owned Blinkit, Swiggy’s Instamart and YC Continuity-backed Zepto — can reach an estimated 25 million households, who are likely to spend an average of 4,000 to 5,000 rupees ($48 to $60) per month, according to Bank of America.

The top players are expected to expand their reach to 45 to 55 cities within the next 3 to 5 years, up from the current 25 cities, BofA added. Regular customers of quick commerce platforms typically order three to four times per month, with retention rates as high as 60% to 65%. Top users, however, make even more frequent transactions, ranging from 30 to 40 times per month, BofA analysts wrote in a note Monday.

“Quick commerce model had its own challenges in Europe and USA but in India, especially in top markets, product-market fit development was led by users liking the experience when things are delivered faster to them at doorstep,” the analysts wrote. “These users don’t want to go back to local corner stores and spend 10 to 15 minutes/fuel extra. The usage started from top cities like Bengaluru, Delhi-NCR, Kolkata etc and then has moved to even smaller cities like Indore, Pune, Rajkot etc.”

Zomato’s Blinkit leads the quick commerce market in India, having cornered as much as 46% of the market share by GMV in the quarter that ended in December, according to a separate analysis.

Swiggy’s Instamart follows with a 27% share; newcomer Zepto has quickly gained ground, securing 21% of the market; and Bigbasket’s BB Now trails with a 7% share, brokerage firm JM Financial said. Reliance Retail–backed Dunzo, which pioneered the quick commerce model in India, has virtually ceded its entire market share to competition.

“With more than 10 active players, the space was very competitive a couple of years back,” JM Financial wrote of the quick commerce market in a recent note. “It appeared that an intense phase of multi-year cash-burn would soon follow. However, contrary to expectations, several players including some well-funded ones folded early in their endeavour. While some faced funding challenges, a few others were affected by structural issues such as lack of product market fit, inability to solve the hyperlocal complexity, inability to build a robust end-to-end supply chain and … failure to create a strong brand recall.”

As quick commerce players vie for a larger slice of the market, the success of their ventures hinges on the development of efficient supply chains. Companies are making substantial investments in dark store operations, streamlining inventory management and establishing direct partnerships with FMCG manufacturers and farmers. By circumventing traditional distribution channels, these firms aim to enhance product quality, expedite delivery times, and boost overall operational efficiency, industry analysts said.

Dark stores, the backbone of quick commerce operations, have significantly expanded their product offerings, now carrying over 6,000 SKUs per store, a substantial increase from the 2,000 to 4,000 SKUs they housed just a few years ago. In contrast, traditional neighborhood kirana stores, which are ubiquitous across Indian cities, towns, and villages, typically stock between 1,000 and 1,500 items, according to JM Financial. Large modern retail stores, on the other hand, offer a much wider selection, with 15,000 to 20,000 items available to customers.

There has also been a noticeable surge in average order value among quick commerce players, which has risen to up to 650 rupees ($7.8) from the previous range of 350 to 400 rupees. This increase in average order value sets quick commerce apart from kirana stores, where customers typically spend between Rs 100 and Rs 200 per transaction.

While the convenience offered by quick commerce is undeniable, profitability remains a concern for investors. Blinkit — which Zomato acquired in 2022 — aims to achieve adjusted EBITDA break-even by the first quarter of fiscal year 2025, while Zepto has set its sights on EBITDA profitability in 2024. Swiggy’s Instamart is also focusing on profitability, with the parent company indicating that the peak of investments in the business is now behind them. Swiggy turned its food delivery business profitable last year.

Many of these players are trying to improve their margins by increasingly looking beyond the grocery category. All the top three players today sell consumer electronics items, a category that makes about half of the sales on Flipkart and Amazon India by GMV, according to people familiar with the matter. (So it should not come as a surprise that Flipkart is weighing entering the quick commerce market by as early as May this year.)

Additionally, advertising revenues currently account for around 3% to 3.5% of quick commerce platforms’ total revenue and could easily reach 4.5%, primarily driven by direct-to-consumer platforms, BofA said. These platforms are also exploring private label strategies in certain categories, it added.