After recent launches in the United Kingdom and Ireland, workforce management platform Rippling is continuing its ambitious international expansion with the opening of its Asia-Pacific headquarters in Sydney, Australia today. The company, which already has 15,000 customers and is valued at $11.25 billion, will invest millions of dollars in its APAC expansion, co-founder Parker Conrad (pictured above) tells TechCrunch, and already has 30 people in its Sydney office, with plans to hire more for its sales, marketing and product teams.

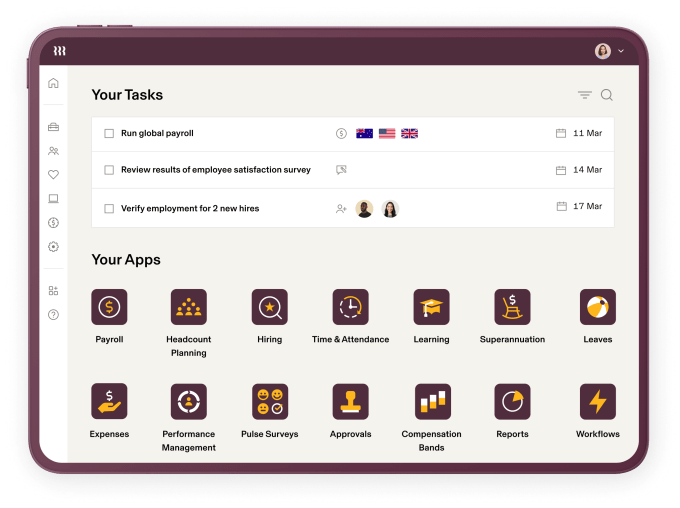

The last time Rippling hit TechCrunch, it was when it raised a whooping $500 million in just 12 hours after the collapse of Silicon Valley Bank. The platform combines human resources, IT and finance on single platform, enabling companies to manage operations more efficiently. One of Rippling’s priorities is R&D and new products created specifically for APAC. In addition to its Sydney HQ, Rippling also has an office in India and is now available in Singapore. Its next APAC launch will be in New Zealand, with other markets planned. Matt Loop, the former vice president of Asia at Slack, will oversee Rippling’s expansion throughout APAC as its new VP and head of Asia.

Rippling’s entrance into APAC follows launches earlier this year in the United Kingdom and Ireland, where its European headquarters are located. Its Australian customers already include SiteMate, Liven, Omniscient Neurotechnology (O8t) and global companies like Notion, Anduril and Anthropic.

Conrad says Rippling expects APAC to generate hundreds of million, and eventually billions of dollars, in revenue. The company decided the time was right to expand into the region because many of its customers have a lot of employees in countries like Australia and India. Rippling also observed that Australian companies are willing to spend heavily on software and other technology. Another reason is that there isn’t a local player that combines all the features that Rippling does.

Conrad and co-founder Prasanna Sankar created Rippling because employee data is often stored in different systems that don’t connect with each other, making it difficult for departments to support workers, share information or collaborate. By enabling businesses to manage HR, IT and finance in one place, Rippling makes it easier for them to manage things like policies applicable to different employees, approvals and detailed budget reports.

Conrad says Rippling’s main competitor in Australia is Employment Hero. The Sydney-based company also integrates HR, payroll and benefits features and, like Rippling, is targeting global expansion. But Conrad says Rippling’s advantages include a deeper integration between its payroll and HR systems.

“There’s one local provider that a lot of people are using and we think that we can bring a product to market in Australia that solves a lot of problems that employers have with Employment Hero, with a native, deeply-integrated payroll,” he says. Another advantage he says Rippling has is that it is used in 40 countries, making it easier for businesses to pay international employees.

Conrad adds that Rippling will invest heavily in R&D spending next year and include “fundamental improvements” in features like analytics, workflows, permissions, dashboards and expense management.

“These are not just built for Australia,” he says. “They’re built globally to work for every country, but it makes the product dramatically better in Australia as well.”

Addressing APAC

Before launching in Australia, Rippling localized several aspects of its platform, especially in payroll and HR. For example, it can handle Modern Awards, or the document that states the minimum entitlements Australian employees get from their job. Rippling is able to support a worker’s Modern Awards through its HR system for things like leave management, pay and benefits. It also handles superannuation, or workplace pensions, tax file numbers and other aspects of employment in Australia.

Another aspect of localizing is helping employers deal with compliance, especially as regulations and laws change. In Australia this includes the relatively recent Closing the Loopholes Act which, among other things, set minimum standards for “employee-like” workers and creates new definitions for casual workers.

Conrad says Rippling has already built an underlying system that can handle compliance in new places. For example, the company often enters a new market and discovers that their regulations are similar to ones in, say, France or the United States. When Rippling encounters new types of regulations, it builds those capabilities further down the stack, so it can be adapted for other countries.

“As a result of that, it’s gotten to the point where as we launch in new countries, it’s not that hard for us to do it,” he says. “A lot of the things that we’re building, we don’t actually have to build. We have to assemble almost like a recipe from the underlying capabilities. So that makes it a lot faster and also makes the system more powerful because it means things that would take a long time for a local company to build already exist in Rippling.”

Rippling typically works with companies that have up to 1,000 employees, but is now also closing in on ones with 3,000 employees. Its other rivals include Paycom and Paylocity, but Conrad says they only compete with them in the United States. In Australia, Rippling’s main rival is Employment Hero, but Conrad says its competitive advantages include building a much broader product suite that not only includes a HR cloud, but also a finance cloud that helps with tasks like expense reimbursements and paying bills. On the IT side, Rippling can handle device management, single sign-on and help employers manage user provisioning on different applications.

As Rippling scales in APAC, its will hire a “reasonably large sales team” in Australia to reach out to companies. It also plans to grow the rest of its Australian team aggressively.

“Rippling really should feel like an Australian system to anyone that’s using it in Australia,” Conrad says, adding, “In each market we’re looking at what are the things we need to integrate with, what are the ways we automate things like retirement benefits, payroll, compliance and that’s where all of that stuff is very, very country-specific.”