SUMA Wealth now has $2.2 million in new capital to continue developing financial tools, content and live and digital activations for young U.S. Latinos to build wealth.

Radicle Impact led the investment with participation from Vamos Ventures, OVO fund and American Heart Association Impact fund. They join investors from previous rounds, including Ulu Ventures, Female Founders Fund and Chingona Ventures. This brings SUMA’s total funding to $5.5 million dollars.

We first profiled the California-based fintech company when it exhibited as part of the Battlefield 200 at TechCrunch Disrupt 2022. Beatriz Acevedo started the company with Mary Hernandez and Xavier Gutierrez a few years ago to build a financial app designed for Latinos — a demographic she believes is often overlooked.

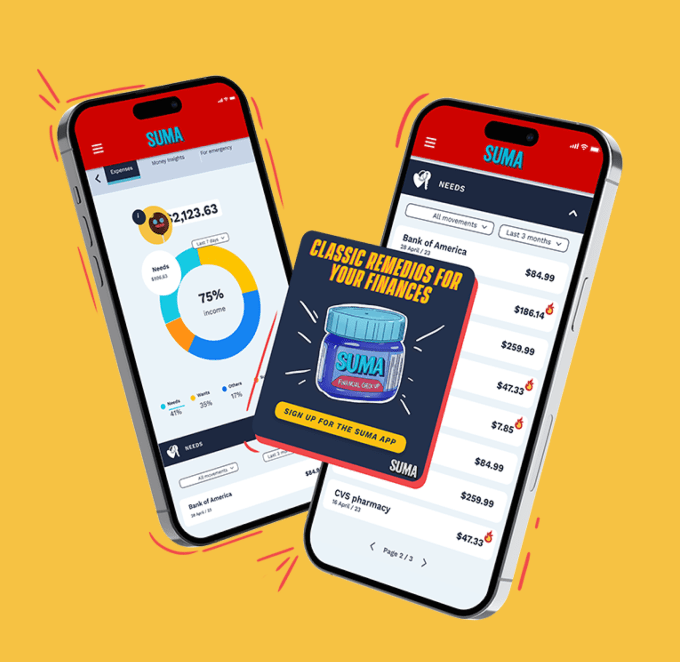

It offers in-culture financial content, products and experiences to help them gain control of their economic power and build wealth. SUMA Wealth also works with financial institutions, including Morgan Stanley, JP Morgan and Wells Fargo, looking to engage with the Latino demographic.

“We really lean hard into the AI features to be able to highly personalize how you spend your money and how you can do better, but also that our community comes from so many different countries of origin,” Acevedo told TechCrunch. “It was very important that even on the features, even on the tone and the voice, even on the content that we serve you for education on what you’re trying to learn and accomplish, we do it in a way that is fully customized and personalized.”

Suma Wealth helps Latinos build credit through gaming, in-culture content

That means that if you’re Venezuelan, the app knows that and uses references and examples of things that are familiar to that culture or uses a tone similar to one of your family members, she explained.

In addition to the consumer app, Acevedo was also working on an enterprise offering. That has since launched, as did a new version of the app in December, and both of those entities have now reached 1 million users.

Apparently, that personalization is catching on with users. SUMA Wealth’s platforms have seen 62% annual user growth. The app continues to be free for users, however, the company is monetizing its partnerships with different brands, including dating app Match.com, or for features such as more personalized coaching. The enterprise app is also subscription-based for companies to buy for employees or their own customers.

And while Acevedo built SUMA Wealth for young U.S. Latinos and their families, what has surprised her is the adoption of the app by non-Latinos.

“Thirty percent are not Latinos, even though our jokes, our insights and our images are very unapologetically Latino,” Acevedo said. “This is a place where people feel welcome. We’re excited to see that not just Latinos have gravitated to the app and find our tools and our content useful.”

In addition to the customer growth, SUMA Wealth’s revenue increased nearly five times in the past year. It has also made some acquisitions: Intellecto, a learning management system to further personalize the user learning experience.

This followed the February 2023 acquisition of savings and personal finance platform Reel. As part of that acquisition, Reel co-founder and CEO Daniela Corrente joined SUMA as chief strategy and business officer.

Meanwhile, this new funding will go toward the Intellecto acquisition as well on new hires across engineering, product and sales. The company is also working on expanding its technology offerings for more AI personalization, data and analytics.

Where top VCs are investing in fintech