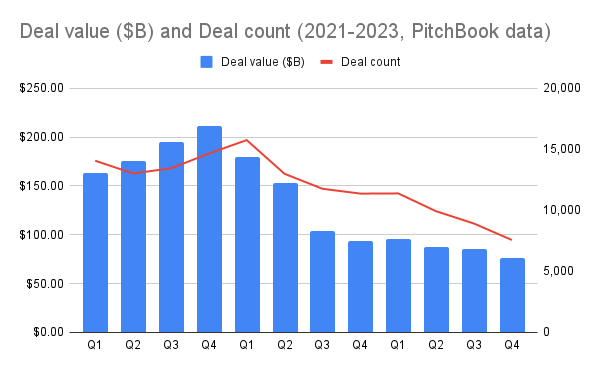

Even though news of potential interest rate cuts has led to optimism that the IPO window might reopen and things might improve in startup land, it appears the global venture capital market has yet to level out: Early data from PitchBook indicates global VC investment in startups continued to slide in the fourth quarter of 2023.

The Exchange explores startups, markets and money.

Read it every morning on TechCrunch+ or get The Exchange newsletter every Saturday.

While things are down sharply in the United States compared to the heady days of 2021, investment trends seem to have largely reached a new normal — U.S. startups raised $37.5 billion in Q4 2023, which wasn’t much less than the $37.6 billion they raised in Q2 2023 and the $39.8 billion in Q4 2022.

In contrast, here’s what’s happening globally:

We are still going down, folks!

To be honest, I had expected to find a somewhat boring number in Q4, in range of recent investment trends, and not a nadir. However, full-year totals led me somewhat astray.

Startups across the world raised about $345.7 billion last year, per PitchBook. That’s not a huge departure from the $333.4 billion raised in 2019 or the $351.2 billion raised in 2018. However, the Q4 2023 result of $76.6 billion is the lowest amount startups have raised in a fourth quarter since 2017. So, 2023 as a whole looks better than it really was because we saw more money raised in the early quarters.

So, the situation has been worsening steadily and if this continued weakness persists in the new year, we could start to see global VC investment retreat to prior norms.

This is not an academic datapoint; it indicates that the pangs we’ve been feeling in various startup markets is very real. This is what I am talking about:

Latin America’s Q3 2023 venture results show glimmers of lightIndia’s top VCs face fresh obstacles as startup investment plummetsLast year was a tough period for African growth-stage startups and 2024 presents a mixed bagSoutheast Asia funding at its lowest level in six yearsFate of US venture capital in China teeters on uncertaintyChina VC deals plunge, on track for worst pace in more than seven years

It’s pretty tough out there.

That’s a shame. One of the more interesting (and encouraging) developments of the 2021 venture boom was that lots of capital was invested in historically underinvested areas. That trend has nearly disappeared, meaning that an entire grip of startups out there is probably finding that critical sources of capital have evaporated.

To be more cynical: The trend of every major geography seeing venture capital interest appears to have been — for now — a ZIRP (zero interest-rate policy) phenomenon. Alas.

What’s worse, investors themselves are raising less capital now. According to PitchBook, venture capital firms across the world raised only $160.9 billion in total last year, the lowest figure since 2015, when VCs raised just $119.3 billion. For reference, VCs raised $174.9 billion in 2016, and that number rose to a peak of $379.7 billion in 2021.

Just to connect the dots: Venture capitalists raised less money last year, so there’s likely less capital available for investment this year. That means there’s no reason to anticipate venture investment to rebound in a material way.

Of course, things could turn around. There’s a chance interest rates might be cut this year, which could help wake things up from the current downturn. Without something significant changing the dynamic, I can’t find a solid argument for why 2024 global venture activity should recover. Certain markets like Europe and the United States appear best positioned to have a good year, but for the rest of the world, prospects look dim.