Circle Internet Financial (Circle) has confidentially filed for a proposed IPO, the company said on Thursday.

Circle is the issuer of the stablecoin USDC, which has the second-largest market capitalization on the market, worth about $25.25 billion, according to CoinMarketCap. The largest stablecoin, Tether, had a market cap of $94.65 billion, at the time of publication.

The number of shares and price range for the proposed IPO is yet to be determined, the company said. Circle did not immediately respond to queries on how this IPO will be different from its previous SPAC efforts.

Private filings for public offerings came into effect thanks to the JOBS Act of 2012, which allowed companies with less than $1 billion in revenue to get their paperwork started without having to disclose the numbers to the general public for some time.

Two SPACs and an IPO

This is not Circle’s first attempt at the public markets.

The company initially planned to list on the public markets in July 2021 by way of a SPAC merger deal with Concord Acquisition Corp. SPACs were all the rage at the time, and the company seemed like a reasonable candidate for a blank-check merger, as it would have allowed Circle to raise capital with a somewhat less proven business model.

Later, when the company decided to effectively double its SPAC value in February 2022, we noted that the repricing was predicated on a massive run-up in the amount of USDC in circulation.

That was around the same time that the United States’ central bank started to raise interest rates. That had several effects on the world economy, and naturally, on the value of crypto assets. Overall, the market suffered as capital became more expensive, but fintech companies in particular benefited from interest-derived revenues since they held cash and cash-like investments on their books.

Circle was one of the companies to benefit from this. It would be simple to presume that as money became more valuable, Circle’s own bucket of cash and equivalents would generate more revenue over time, but we can actually do a bit better.

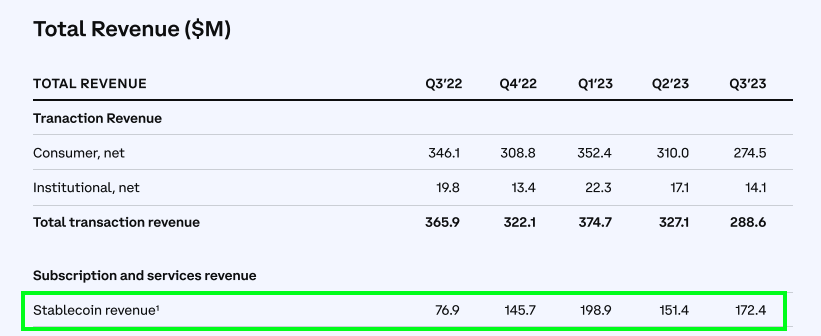

Here’s how Coinbase reported “Stablecoin revenue” in its most recent quarter:

We can see that Coinbase’s stablecoin revenue rose 124% in a single year — that is quick. And how does Coinbase generate stablecoin revenue? The company says it’s “derived from our arrangement with the issuer of USDC,” AKA Circle.

From Coinbase’s numbers, then, we can get a feel for how quickly Circle itself has grown. And numbers like the above really do smell like public company-level math.

There are questions ahead of Circle. When the Fed starts to cut rates, the value of its holdings, in terms of interest-derived yields, could fall. And Circle is not winning the U.S. dollar stablecoin race either — Tether is far ahead in terms of total units in the market today. Circle has also shed more than half of its total USDC in circulation since its peak in mid-2022, though CoinMarketCap data indicates that the company is starting to see its circulating supply begin to recover, albeit slowly.

All that sums up why the Circle IPO filing does not come as a shock. We know that Circle wants to go public; it has tried to do so before. We know that the business of sitting on a pile of cash is more lucrative now than it has been in memory. We also understand that Circle is seeing its circulating supply grow again, answering what would have been the first investor question during its roadshow. Finally, the market expects interest rate cuts this year.

In short, it’s the perfect window of time for Circle to try to get out the door.

Would that other private tech companies were as bold.