Ingrid, a startup out of Stockholm, Sweden, not this writer (unfortunately), has raised €21 million (~$23 million) to fuel the growth of a business aiming to improve the last, messy mile of online shopping — delivery. Using data science and some big ideas about how delivery will evolve in the years ahead — for example, it thinks we should move away from free shipping — the company is on an ambitious track to expand to more markets in Europe.

Among the many stress points in the e-commerce machine, delivery has long been seen as one of the more painful ones. It can cost a lot (both to buyers and sellers); the process feels very out of everyone’s hands, especially when something goes wrong (especially annoying when we’ve paid for that “privilege”); it can feel like it has undue environmental impact; and it’s been turned into a competitive edge by behemoths like Amazon with its Prime memberships offering “free” shipping, making it something any other retailers will be forever chasing with a direct hit to their margins.

“Delivery is the biggest unsolved puzzle,” Piotr Zaleski, Ingrid’s co-founder and CEO, said in an interview. “It’s where most things go wrong.”

Ingrid has seen all of this, and it believes it can fix it, with a platform that it has built to cover what Zaleski describes as the “end-to-end” delivery experience.

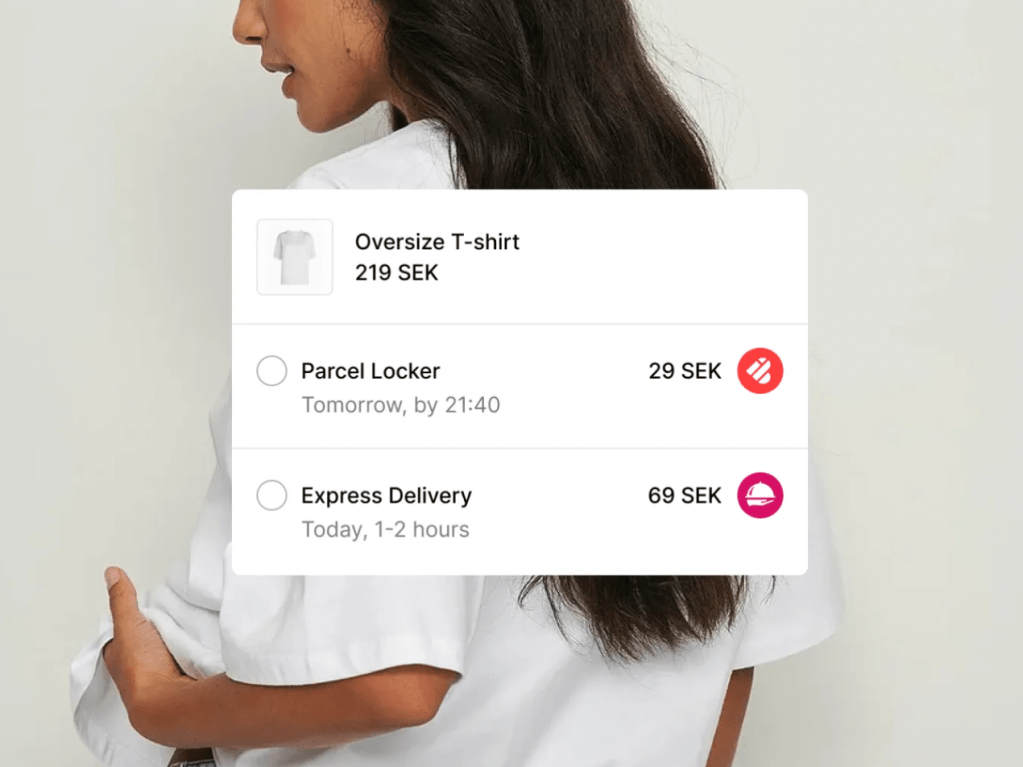

By way of an API, its services are integrated into a retailer’s purchasing flow, so that buyers can get a more accurate, and earlier idea of shipment pricing to avoid checkout shock and subsequent cart abandonment.

Ingrid provides integrations with whichever delivery providers a particular retailer uses — and can help those retailers add in more carriers, or delivery points — to provide choices to consumers around which delivery service, speed and price they want to use. Ingrid then helps manage the process post-sale, from tracking the order to the customer to helping with the returns process if it’s needed, by way of the fact that it acquired a returns specialist, Turnr, last year and integrated it into its bigger platform.

And in case you are at all curious: Ingrid the business was not named to ensure coverage in TechCrunch by me, Ingrid. It was a more random decision: Zaleski and his co-founder Anders Ekman (chief business development officer) wanted a relatable and positive name that would resonate in its first markets, in the Nordics, and that it could export but keep some of its Scandinavian ethos in the future branding. Searching on different names, it found that Ingrid.com was registered to a private individual — a woman whose father worked in tech in the 1990s and presciently bought a domain name for his daughter with her name, in case she needed it one day. The Ingrid founders were shocked to see that it wasn’t snagged already by a domain squatter asking for a ridiculous price, as so many of the simplest domains are; so it made a deal and managed to get her to agree to sell it.

Turning back to Ingrid the startup, the company’s basic understanding is that for any retailer that is not Amazon, fulfillment and logistics are not the core of what they do, and for those whose speciality is delivery, they are not experts in e-commerce, so providing a service that can stitch these together better will be useful to both.

Ingrid’s platform currently serves some 250 customers across 180 countries, and to date it’s processed 130 million orders for them (currently around 40 million annually). It’s not disclosing revenues or valuation with this round, which brings the total amount raised by the startup to €32 million.

Ingrid has identified a very obvious problem that most certainly can use fixing, but it also faces a few challenges.

The first of these is what Zaleski admits is a “cold-start” problem. It’s much easier for a company to build out a business on a network of existing relationships than it is to build that business from scratch. So, while the company now has an impressive 20% share of the consumer market in its home country of Sweden — Zaleski told me that “more than 15% of consumers” shopping online will use Ingrid in one way or another — and while that will serve it to grow well in the years to come judging by the acceleration of the business, it spells more challenges when Ingrid wants to break into totally new markets.

One solution to that is to ride on the coattails of its bigger customers and expand by working with them in new markets, which is what Ingrid is doing. “The only way is to build a hell of a platform that retailers want to use to take a volume position,” Zaleski said. Ingrid’s current customer list includes Paul Smith, ME+EM, Sneakersnstuff, Estrid and Farmasiet.

Another challenge is the fact that there are many others that have identified the same challenges as Ingrid and are also building delivery management platforms to address them. FarEye, Shipsy and many others may have different approaches, products and geographies where they operate, but the fact remains that they are all providing solutions to the same problems.

For Ingrid, the focus and success in its current region becomes its unique selling point. It’s also using data science to help optimize the whole process. Not only is it increasingly understanding the segmentation of consumers, but it’s also able to serve them options that it believes are more likely to be used as a result.

Indeed, all of this is what caught the eye of investors this time around

“We’ve been looking at e-commerce enablement software for a long time, and yes, it’s quite a crowded space and it takes time to understand how it works,” said Paula Ruiz Azcue, a director at Verdane who led the investment for the firm alongside Schibsted Ventures, the venture arm of the media company. “But because we know the companies we can dissect [the space] and identify the winners. We like how Ingrid is so focused on customer experience. They’ve optimized on that while others are still thinking from the logistics point of view.”

And that brings us to the third challenge, although Zaleski does not see it that way. Yes, customer service and a higher idea of customers preferring certain services over others even if they are more expensive, feels like a worthy idea. It means that a buyer might opt for a more expensive delivery route because it’s more eco-friendly, for example, if that customer wants to prioritize that. But realistically, a lot of customers will just go for whatever are the cheaper options. That is one reason why Prime and Amazon continue to kill it in the market, and why they have forced the hand of so many others to figure out how also to provide “free shipping.”

The reality is that free is never really free, and Zaleski and Ingrid believe that longer term this is not a goal anyone should be chasing, because it will ultimately kill businesses with margin hits. So, while a delivery platform might potentially consider a product that effectively builds an Amazon Prime–style competitor for retailers that want to offer those benefits but want to avoid paying fees to Amazon, or losing critical customer ownership in the process, Zaleski said that Ingrid will not be the one to build it.

“I’m against free shipping,” he said. But he does have a very socialized approach to ways to cut down shipping costs and pass savings on to buyers in markets where Ingrid has strong penetration. “If you use our platform, and multiple retailers are also using it, you can agree to, say, a Thursday where parcels are delivered in one area for all those retailers, versus spread out across the week. That would mean money to be saved on carrier side.”

That ultimately will rely, again, on Ingrid scaling.